We have been lucky in Australia that our stock market hasn’t been as hard hit as those around the world, but that doesn’t mean that we have got out unscathed either. In fact since the highest high in September 2007 to today the All Ords is still down around 30 per cent.

Whether you believe the doom and gloom news reports that we are headed for a double dip recession or not (personally I don’t think we are) it’s clear that people are quite jumpy right now about investing in shares.

I’ll agree that this isn’t a good time for short term strategies (unless you are experienced and know how to short stocks and use options to your advantage) but if you have five or more years to wait it out then right now is a great time to think about getting back into the market when things are still quite cheap.

It’s been proven time and time again that those that make the most money in shares are those that buy low and sell high. Well, right now when everyone is panicking, you can buy low. Everything right now is cheap, or as I like to say, on sale.

In a few years’ time when the market recovers (and it WILL recover, it’s just a matter of waiting it out) those that bought smart will make a lot of money.

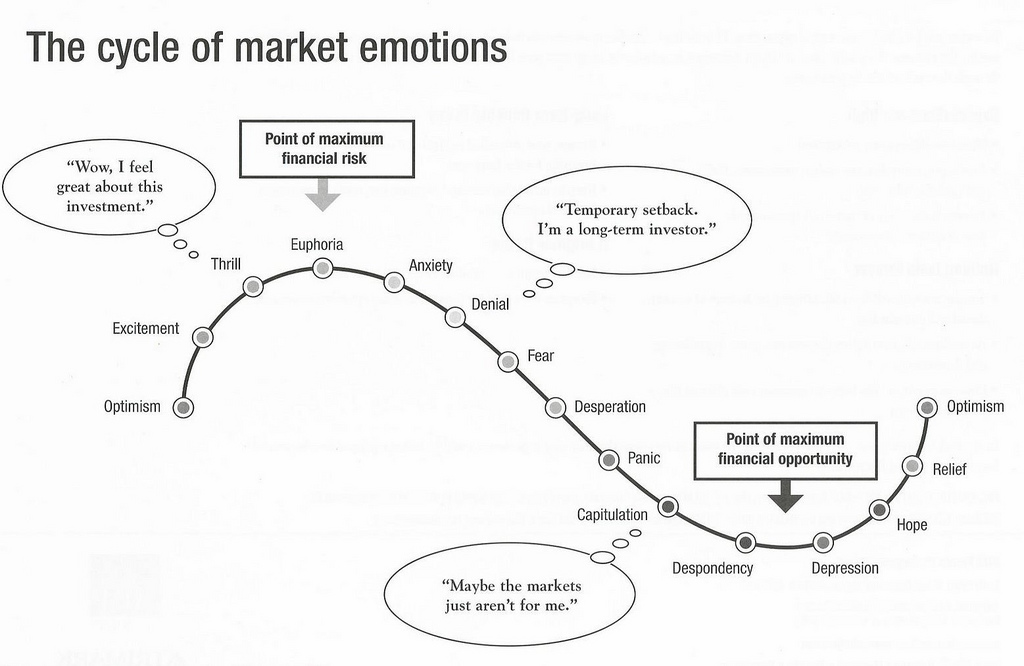

There is a graph that I feel sums up the whole stock market cycle.

As you can see, we are probably right now somewhere near despondency and depression. No one seems to believe it can get any better. But talk to any seasoned investor and they’ll tell you that there have always been market crashes, just as there have always been market rallies. If the image is anything to go by, then we are currently in a period where the greatest financial opportunities exist.

But that doesn’t mean that you should buy any old company that you feel like. It’s still important to stick with the blue chip stocks (those with the largest market capitalisation) since these have historically provided the safest investments for shareholders.

Even if you do nothing else, just buying the top companies will help you to get ahead in the long term. Of course, I’d like it if you also chose those companies with good Return on Equity figures, low debt and high earnings stability. But even if you can only choose the first rule – choosing the market leaders, you can still do ok in the long run.

Have a look in the ASX20 index to see which companies you like the look of. These companies are the bluest of the blue chips and probably the ones that you know the most about already anyway.

If you can’t choose between then, just buy the index instead and you’ll have all of the stocks in the ASX20 or all the blue chips. That’s a quick and easy way to diversify your portfolio if you haven’t got much money to start with.

Over history most market crashes and recessions last around three to five years. If that’s the case we only have a year or so to wait it out (two max) before the market starts to recover.

And wouldn’t you want to be holding onto some great companies when that happens? Investing in Australian blue chip shares is probably the safest way to get back into the market before the next rally. Whether you have to wait a few months or a year or two (most likely you’ll still need to wait twelve months or more), after everything is rosy again, you’ll be happy that you did.

1 Comment

Hi Tracey, I have just discovered you on youtube. I find your posts very informative and have given me some new ideas, regards, Steve