Having monthly income from your investment portfolio can be really helpful. Especially if you rely on that income for paying your bills or, if you’re like me, you live off the dividend income.

In my investment portfolio, I have a mix of both individual companies and ETFs. But I know many people prefer buying ETFs because it’s an easy way to invest. You get instant diversification and the hard work is done for you.

However, at least here in Australia, the majority of the ETFs pay either quarterly or twice per year. But, there are some ETFs within Australia that pay you dividends every month so let’s have a look at those in this article.

The 3 Most Popular Monthly Dividend ETFs in Australia

Let’s get right into it, with three of the biggest monthly dividend ETFs. All the information that I’m presenting in this article is correct at the time of writing but is subject to change over time. And, I’m just giving you the main information about the fund. You’ll need to do further research before you decide to invest in anything. Due diligence first, always!

EIGA – EINVEST INCOME GENERATOR FUND

EIGA’s main strategy is reasonably straightforward, and that’s to invest in diversified high-paying dividend companies listed on the ASX.

The capital growth on this fund has averaged 6.88% p.a. over the past three years.

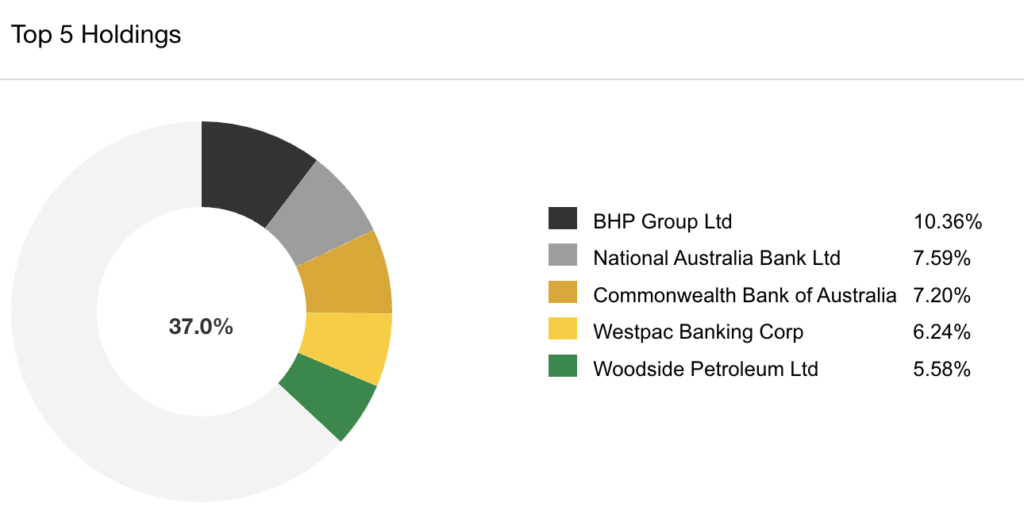

Currently, the top five holdings make up 37% of the fund overall, so over one-third of the fund weighting is held by just five companies. They are BHP Group, National Australia Bank, Commonwealth Bank, Westpac, and Woodside Petroleum.

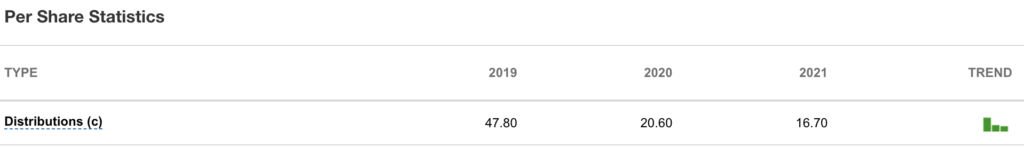

The distributions of the fund have been falling over the past three years, so do keep that in mind, also taking into account that dividends during 2020 and 2021 did get reduced or stopped for many companies due to the pandemic. This was especially the case with the banks, this sector making up a large weighting of this fund.

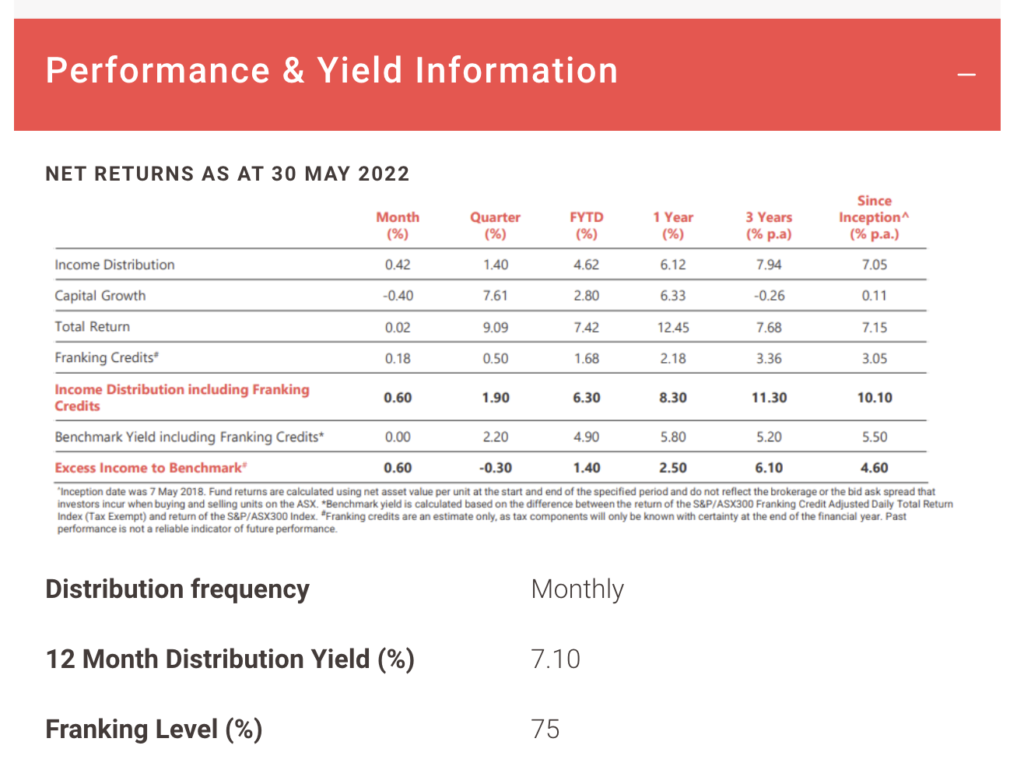

The distribution yield has been a healthy 7.1% over the past twelve months, with a franking level of 75%.

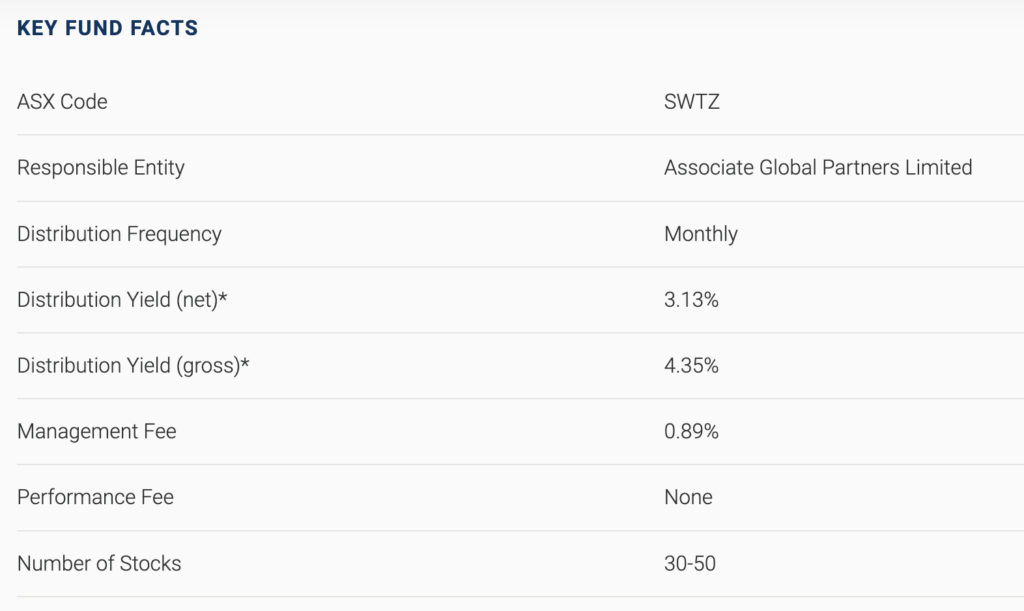

SWTZ – SWITZER DIVIDEND GROWTH FUND

SWTZ’s objective is to invest in blue chip Australian shares with good income and long term capital growth potential.

Currently, the capital growth market return of the fund has averaged 6.33% p.a. over the past three years.

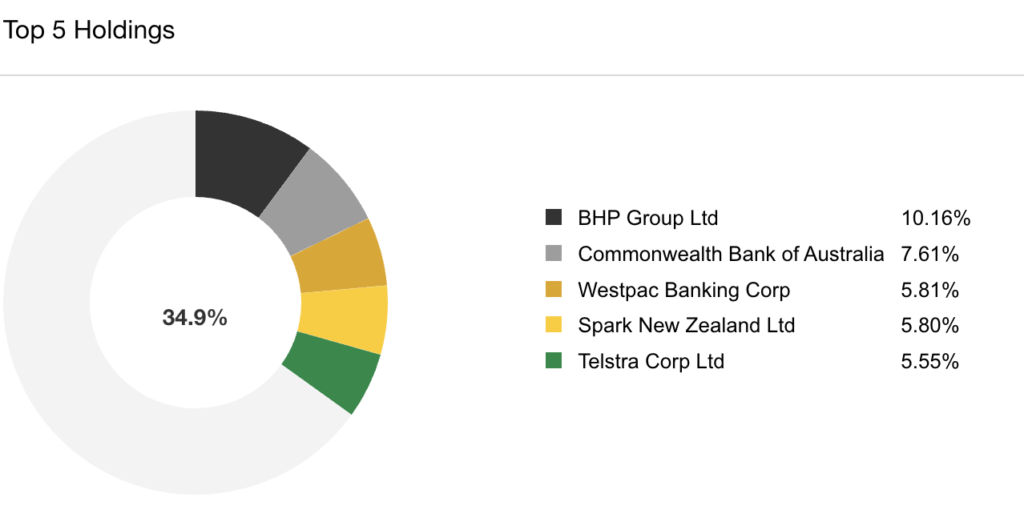

The top five holdings in terms of weighting, make up 34.9% of the fund. Its holdings are similar to EIGA’s, with a few key differences. Currently, the biggest five holdings are BHP Group, Commonwealth Bank, Westpac, Spark New Zealand, and Telstra.

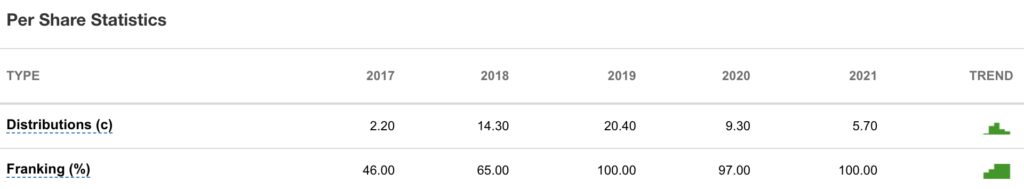

Like the previous fund, the distributions for SWTZ have been decreasing, especially during 2020 and 2021. Again this is likely due to a large holding in many companies that cut or delayed their dividends during those years.

Their distribution yield is lower than the previous fund since they aim for both income and capital growth. Currently, they have a yield of 3.13% p.a. All the distributions are 100% franked though, for those looking for those tax benefits.

HVST – BETASHARES AUSTRALIA DIVIDEND HARVESTER FUND

HVST is arguably one of the more controversial dividend funds in Australia. Their strategy, as the name implies, was to ‘harvest’ the dividends from companies. This meant that they bought a company just before the dividend was due to pay out and then sold again some time after.

And while the income was high from the dividends captured, it was losing money in capital gains as the price of the fund began to fall over time.

They have, however, since changed their strategy as of 31 May 2022.

They still want to provide opportunities for a high monthly income that looks to exceed that of the general market, but are becoming less aggressive in their buy and sell strategy (which has reduced their fees slightly, although they still remain high).

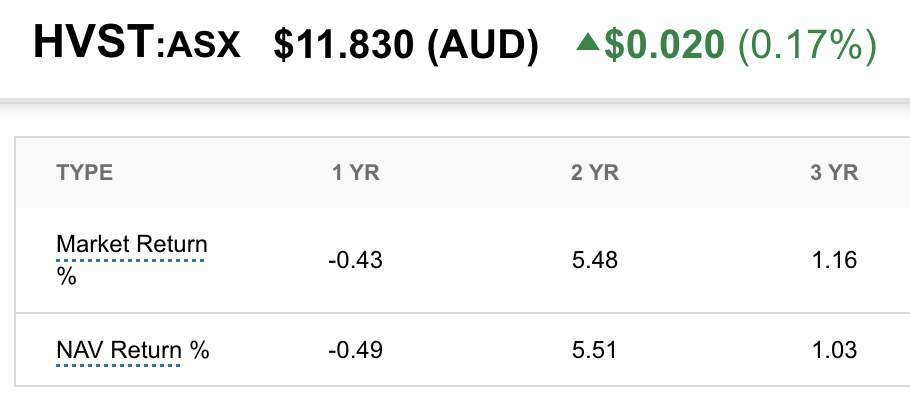

If we look at the capital growth over the past three years, it has only increased an average of 1.16% p.a., and there were many years where the capital growth decreased due to buying high and selling lower once the dividends were paid out

It will be interesting to see what happens to their performance going forward now that they’ve changed their strategy.

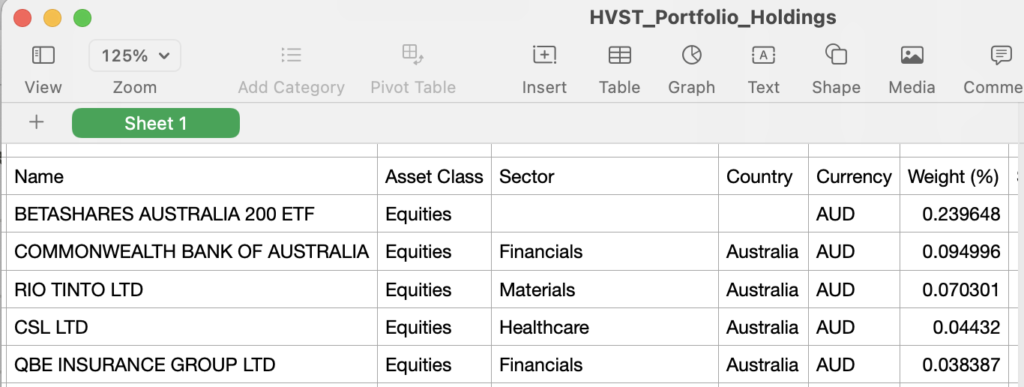

As of 8 July 2020, their top five holdings are the Betashares Australia 200 ETF, Commonwealth Bank, Rio Tinto, CSL, and QBE. Since they are actively trading, this could change, however in the future.

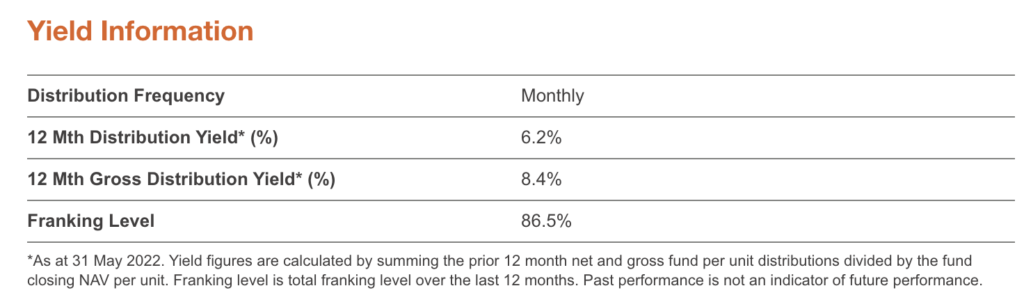

The distribution yield is currently 6.2% p.a. with a 86.5% franking level.

Eight More ETFs That Pay Monthly

There are a few smaller ETFs that also pay monthly. These tend to have less volume overall but could be worth further research to see if they fit in with your portfolio goals.

We’ll start with four from different fund managers, then look at four more that are from Betashares.

- PL8 – Plato Income Maximiser Ltd – Div Yield 4.2% – Increased 10.19% past 5 years

- QRI – Qualitas Real Estate Income Fund – Div Yield 6.1% – Decreased 16.17% past 5 years

- GCI – Gryphon Capital Income Trust – Div Yield 2.7% – Decreased 0.75% past 5 years

- MXT – Metrics Master Income Trust – Div Yield 2.7% – Decreased 3.41% past 5 years

Of these four, PL8 is the more popular of the smaller monthly funds, mostly because it has both a good yield and has increased over the past five years. In contrast, while the other funds have good yields (QRI in particular) they have all decreased in price over the past five years.

Just a note that these figures are not per annum, but over the entire five years. The distribution yields are the yields quoted on the Commsec website, and the capital growth (or loss) figures are from Google charts.

The last four are all from the fund manager Betashares.

- HBRD – Betashares Active Aus Hybrids Fund – Div Yield 2.5% – Increased 4.95% past 3 years

- CRED – Betashares Aus Investment Grade Corporate Bond ETF – Div Yield 5.0% – Decreased 9.57% past 3 years

- BNDS – Betashares West Asset Aus Bond Fund – Div Yield 1.5% – Decreased 8.74% past 3 years

- QPON – Betashares Aus Bank Senior Floating Rate Bond – Div Yield 0.8% – Increased 2.52% past 3 years

These figures are all from the Betashares website.

So those are the main monthly ETFs that are available to investors within Australia. If you are looking for a monthly dividend ETF to add to your portfolio, make sure you take into account both the dividend (or distribution) yield as well as the capital return over the long term (at least five years if that information is available).

Also, look at the volume of the fund to see if there is enough buying and selling. Going with funds (or companies) with low volume can be problematic if you want to buy or sell fast, as there may not be enough buyers or sellers at the time you want to trade.

Happy investing,

Tracey

**

DISCLAIMER: Also this is meant to be informative only, and you need to make your own financial decisions before investing in anything.