If you want to successfully invest in the Australian Stock Market (or any Stock Market the world over for that matter), you’ll need to have some idea of how to pick a profitable company. During my research I came up with a formula, or set of rules, that helped me choose winners over losers more often than not.

I came up with a set of rules for both long term investing and short term investing. The rules are different for each method, so in this post I’ll be concentrating on my rules for long term investing only (the short term ones will be in a later post).

Having these rules was what made Shopping for Shares so popular and well loved. You can get more detail in the book, but as a quick overview, here are the six main criteria:

Shopping for Shares Rules

Rule 1: Choose a Market Leader

Rule 2: Debt to Equity Ratio should be less than 75%

Rule 3: Return on Equity 15% or more

Rule 4: Current 5 year return on the share is good (preferably about 15%)

Rule 5: High Earnings Stability

Rule 6: It’s currently trading at less than 16 times the earnings.

Choosing Market Leaders

I don’t like to invest in obscure companies. Therefore the companies that I choose must be listed AT LEAST in the All Ords (top 500), or preferably in the ASX 200. The companies in those indices represent the market leaders in terms of market capitalisation and are likely to be more stable and well known.

Debt to Equity Ratio under 75%

Companies with high debt to equity ratios make me nervous. While it doesn’t necessarily mean that there are problems in the company, it does mean that if they get into trouble, it’s going to take a lot of work to get them back out. So I’d rather avoid this mess and choose companies that are not living on credit.

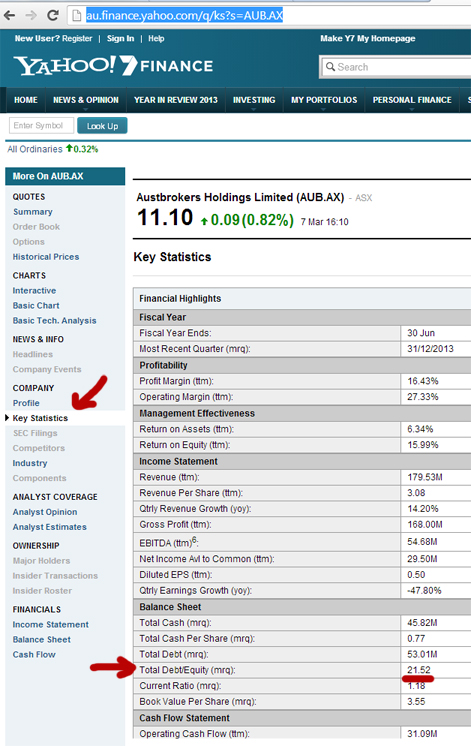

Where do you find Debt to Equity (Using AUB as an example)?

AT YAHOO FINANCE: http://au.finance.yahoo.com/q/ks?s=AUB.AX

Go to the Key Statistics page and look in the right hand column. In this example, AUB’s Debt to Equity is 21.52

ROE at 15% or more

One of my favourite rules, and also one I never waiver on, is that the company must have a Return on Equity (ROE) of 15% or more. ROE measures the amount of profit the company makes on behalf of shareholders. So the higher the ROE the better (usually) the company is financially.

Most investors think ROE is one of the most important indicators of a profitably stock.

Where do you find Return on Equity?

ROE is one of the easiest financials to find since it’s a major criteria for most investors.

Here is Commonwealth Bank’s ROE using Yahoo! Finance from their Key Statistics page: http://au.finance.yahoo.com/q/ks?s=CBA.AX

The share price has increased by 15% over the last five years

Well first the company needs to be listed on the stock exchange for five years or more for this rule to work (so it has proven history) and then it needs to have performed well over those years too.

This is one that you can give a little more room to move on, especially since after the GFC many companies have had a rough few years and are only now moving back into profit again.

High Earnings Stability

It goes without saying that consistency is important for long term investing. While short term investors don’t care too much about stability (in fact they prefer a more volatile stock), if you are going to buy and forget about it (long term) you want to trust that it will perform just as it has in the past. Earnings Stability will usually show this.

Share Price less than 16 times Earnings

And finally if you find companies that fit the shopping for shares rules and you want to buy you want to make sure that they are currently trading at or below 16 times the earnings price (which you can easily find on the company information sheet under research with your online broker).

Well that’s it really – my rules for investing in the stock market.

Hope it helps you!

Tracey

2 Comments

With regards to the last rule: Share Price less than 16 times Earnings. Is earnings the same as Earnings Per Share (EPS) in cents or Earnings Price Ratio?

Thanks for the clarification.

Kindest regards, Claire

Hi Claire,

16 x EPS (Earnings per share). 🙂