One of the biggest questions that I get from readers is that they can’t find any shares that fit all my rules.

One of the biggest questions that I get from readers is that they can’t find any shares that fit all my rules.

The rules state that they be listed in the All Ords, have ROE’s above 15%, low debt, high earnings stability and a decent return over the past 5 years.

And yes it’s absolutely true – good stocks are hard to find and take a little digging 😉

Especially when we’ve just been through a market crash and earnings stability have taken a huge hit on many good companies.

So if you are having trouble finding companies that fit all of the shopping for shares rules then never fear dear reader, because I’ve just finished doing the research for you. (It would have been done a lot earlier but the kids don’t give me as much time to write these days).

The Top 7 Shares That Fit The Shopping For Shares Rules (Plus One More That I Like).

#1 – RFG – Retail Food Group

ROE: 17.9%

Debt/Equity Ratio: 54.6%

Earnings Stability: 82.2%

5 year average return: 24.8%

Dividend Yield: 5.8%

5 year chart:

The reason I like this: Wowza, did you check out that average share price return over the past five years? With everything else falling you’d be forgiven for thinking that you’ll never make money in the stock market. Yet here is little RFG making massive gains for investors.

Ka-ching!

#2 – AUB – AustBroker

ROE: 15.0%

Debt/Equity Ratio: 24.8%

Earnings Stability: 82.4%

5 year average return: 12.8%

Dividend Yield: 3.1%

5 year chart:

The reason I like this: It’s got strong fundamentals, has made awesome share price returns over the past five years and has a decent dividend payment.

They deal with financial services and insurance (Warren Buffett particular likes insurance, and no wonder – it makes good money for investors).

A must consider for your portfolio.

#3 – TNE – Technology One

ROE: 28.1%

Debt/Equity Ratio: 4.6%

Earnings Stability: 88.1%

5 year average return: 7.5%

Dividend Yield: 5.5%

5 year chart:

The reason I like this: This is a nice stable little tech company (actually it’s not so little it’s rather massive) that provides software services to business and government.

Apart from a great return for investors and strong fundamentals it also has an awesome dividend yield.

And that high Return on Equity shows that it’s looking good for the future too.

#4 – SDM – Sedgman

ROE: 18.9%

Debt/Equity Ratio: 19.4%

Earnings Stability: 90.3%

5 year average return: 6.9%

Dividend Yield: 1.5%

5 year chart:

The reason I like this: Sedgman is a global resources company that deal mainly in coal and metals. They took a huge hit when the share market fell during the GFC but they are back on track again.

The reason I particular like them is that they are super consistent and stable (check out that strong earnings stability figure) so you are unlikely to get too many surprises with them. Just nice stable returns.

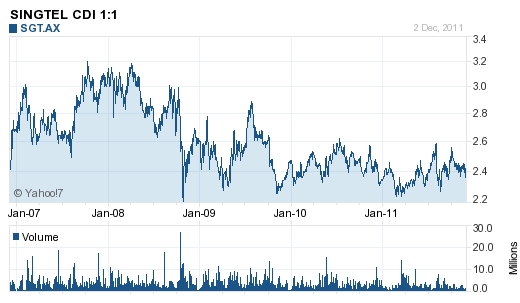

#5 – SGT – Singapore Telecommunications

ROE: 15.5%

Debt/Equity Ratio: 30.0%

Earnings Stability: 83.0%

5 year average return: 6.5%

Dividend Yield: 8.3%

5 year chart:

The reason I like this: Apart from that it has some pretty sweet fundamentals, check out that dividend yield! 8.3% on your investment is an awesome return. So not only has this share increased by an average of 6.5% on the share price, you also get dividend interest of 8.3% on your money.

Can you say win win? Yeah baby.

#6 – WOW – Woolworths Limited

ROE: 27.5%

Debt/Equity Ratio: 63.8%

Earnings Stability: 86.9%

5 year average return: 5.1%

Dividend Yield: 4.8%

5 year chart:

The reason I like this: While it doesn’t have as high an average return over the past five years as the other five shares, it’s still a very decent performer and it’s got a good dividend yield as well.

Woolworths has been growing steadily over the past few years by acquiring many different businesses to help boost it’s profits (liquor, petrol stations, it’s own branded foods, financial services, electronics etc)

I can only see them getting bigger and better for shareholders.

#7 – CBA – Commonwealth Bank

ROE: 18.5%

Debt/Equity Ratio: n/a

Earnings Stability: 81.4%

5 year average return: 6.7%

Dividend Yield: 6.9%

5 year chart:

The reason I like this: Commonwealth Bank is the best of the bank stocks right now. It’s got a strong return on equity, very stable earnings and it has returned a good share price increase for investors. And that dividend yield is also pretty sweet. Whether you bank with them or not, they are a good company to buy shares in.

And my special mention:

#8 – ORL – Oroton Group

ROE: 83.5%

Debt/Equity Ratio: 33.1%

Earnings Stability: 36.0%

5 year average return: 43.1%

Dividend Yield: 5.9%

5 year chart:

The reason I like this: Ok, so I admit I’ve got a bit of a soft spot for Oroton since it was one of the first shares I ever purchased. And it’s been oh so good to me over the years too.

It’s made an average annual return over the past five years of 43.1%. Yes that’s the average ANNUAL RETURN. Kaching!!

Now it doesn’t quite fit all my rules since the earnings stability is quite a bit lower at 36.0% (you’ll find most retail stocks have low earnings due to the financial crisis impacting spending).

But it’s a good stock with a super high ROE, and can only do better once the economy recovers.

—

So there you go. My picks for the top stocks for 2012 that fit all of the shopping for shares rules (mostly).

I was originally going to put this info in a report and charge money for it, but hey it’s Christmas and I’m in a festive mood so it’s available freely on this blog post instead. Enjoy, and I hope it makes you money in 2012 and beyond. Merry Christmas!

To your success in 2012!

Tracey xx

P.S. If you found this post helpful, please consider sharing it on Twitter, Facebook or Google+.

1 Comment

Bought your 2nd edition book in target. Bought shares a couple of years before GFC. Hubby said not to sell that it’ll recover!! Our shares that have recovered are now making up for those that are still below what we paid.Just starting to get there 7 years later! Dividends have been a blessing though. I thought I might start to dabble with your advice in mind. Thanks