With interest rates on the rise, you might be wondering how that is going to affect the stock market. The Reserve Bank of Australia raised rates on 5th July 2022 by 50 basis points. The new cash rate is 1.35% with more rises predicted in the future.

Now we can’t say what exactly will happen to the stock market going forward. We can look at previous periods of high-interest rates and the stock market. And then see if there is any correlation between the two.

Is there any correlation between interest rates and stock market performance?

There hasn’t been a strong relationship between interest rates and stock market performance. In the past, increasing interest rates isn’t a sign of whether it’s likely to go up or down.

A recent article published by The Australian Financial Review confirms this. It goes into detail about how interest rates themselves don’t impact whether stocks rise or fall. Even though investors worry that it will, that isn’t always the case.

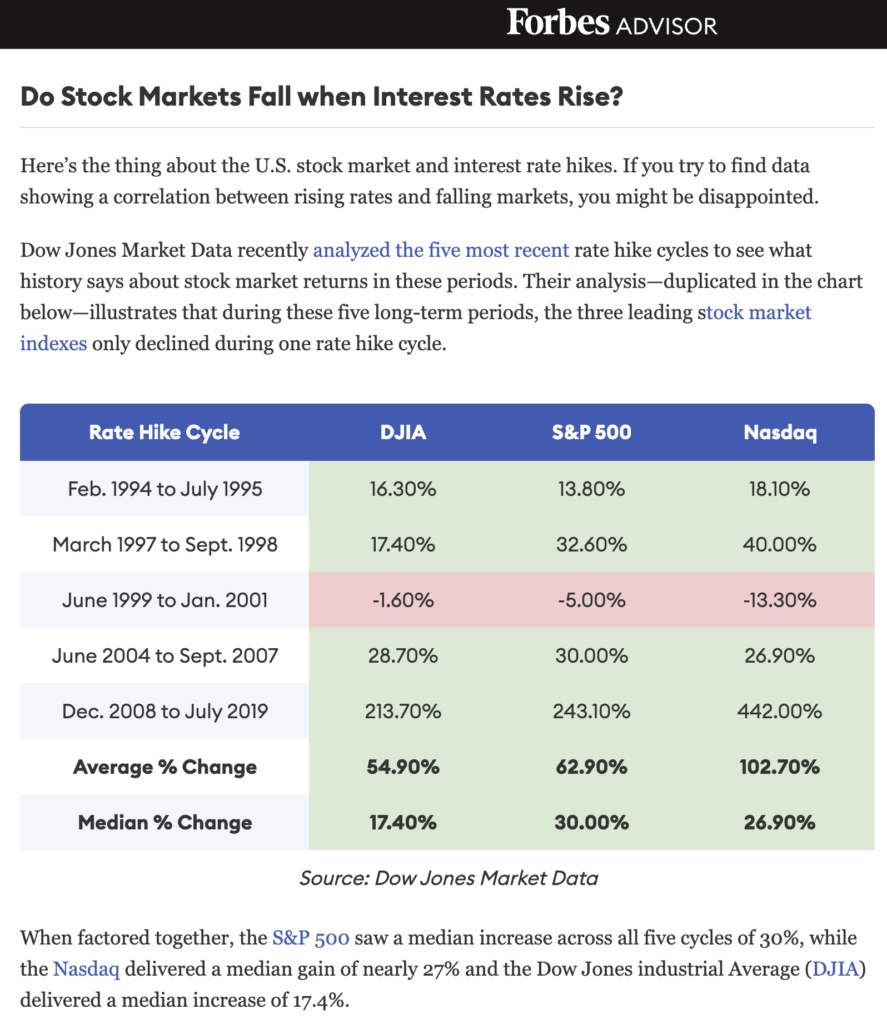

Forbes confirmed this with the Dow Jones Market Data analysis. They looked at the five most recent rate hikes and in only one of the five periods did the stock market fall. In the other four cases, it actually rose. Going to show that there are other factors at play when it comes to whether the stock market will rise or fall.

There will be an impact on certain companies though.

Even so, interest rate hikes will affect some companies and their businesses. It will depend on the nature of each individual business and how they manage income and expenses. Particularly, how the business model relies on borrowing or lending money.

The financial sector is the most obvious one. Particularly if the financial institution lends money to consumers and businesses. The same goes for insurance companies that benefit during high-interest rate periods. They are able to increase prices during these times and thus increase profits.

All financial institutes have to do is follow the guidelines on the new interest rates. Higher interest rates across the board mean more money in their pockets. This of course assumes variable loans rather than fixed which are the norm here in Australia.

Around 70% of home loans here are variable, with the rest fixed rate. Fixed-rate loans tend to only be one to three years with two years being the most common.

Business loans are often fixed, but terms here run much shorter than in other places around the world. The most common fixed period for commercial loans is eighteen months.

As interest rates rise, they will do on savings rates, bonds, and term deposits, as well. So financial institutions will have to pay more to customers for these products too.

But the level of savings compared to the levels of debt is generally inconsequential.

There is more debt and borrowed money than there are savings.

More cash flow usually equals more gains for Investors

So companies that lend out money will have more cash flow on hand. Even without changing their current business model.

When a business reports more cash flow and profits, often the stock price also increases. This assumes normal market conditions. That’s also good news for dividend investors. More excess cash means they are able to increase returns to stockholders. They may choose to do this as higher dividends or sometimes a one-off special dividend. This, of course, depends on their future business plans for growing the business.

What about companies that borrow money?

Let’s turn our attention to the companies that rely on loans and credit to run their business.

They will have to pay the higher interest rates now. That means higher so so less cash flow. Less cash on hand means lower profits for the business unless they can find ways to offset these costs. Often companies will increase prices on their goods or services to consumers. Other times they’ll eat the costs.

If companies do increase the costs of their products or services, this has a trickle effect. Companies who they do business with will experience higher costs too. This causes a domino effect as everyone tries to increase profits to offset expenses.

In the short term, this usually means that because of less cash flow, the stock price is likely to fall. And, if the company pays dividends, lower returns for dividend investors. Unless they can balance out prices again.

Should you invest in companies with high debt?

I’m a dividend investor. That means I invest for the dividend income that companies pay out to shareholders. I rely on the dividend income to pay my everyday expenses. So I need to ensure that my income isn’t interrupted.

So when I’m looking for companies to invest in, one of the criteria that I look at, is how much debt the company holds. I’m looking for companies that have less debt than equity in the company. The formula for calculating it is below since the dollar amount is relative to the size of the company.

Under normal circumstances, investors may not care much about the company’s debt. For growth investors, it can mean that the company is using that money to grow the business. Growth helps the company to make even more profit in the future.

But, as a dividend investor, I take a different stance.

Consistent profits and cash flow are important to consistent dividend payments. Companies with disrupted cash flow could cut their dividend. That’s to ensure they keep the cash for normal operating expenses.

If they cut the dividend, that means reduced income for me.

So that’s why I like to invest in companies with lower debt levels. If any economic change that affects cash flow occurs, the impact will be lower. Companies with higher debt levels will experience higher impacts.

Sectors that take on high debt include: Manufacturing, production, and real estate.

So what does that mean for investors?

If you a long-term investor, it usually means that not a lot will change. The market isn’t likely to change based on interest rates alone. Most stock market changes will depend on other factors as to whether it will rise or fall.

Currently, we are about six months into a bear market, so the market has been falling for some time. However, things have flattened off somewhat over the last month or so. Bear markets generally last between six to nine months before they start to rise again. Based on history, it might be likely, that in the next three to six months it will turn around again. But there are no guarantees.

What I plan on doing is to do what I’ve always done. Invest when I can, hold for the long term, and keep waiting for those dividends to roll into my bank account. I won’t be making any major changes. I doubt my income will change much anyway given the types of companies I invest with.

Anyway, happy investing, and I’ll see you in the following article.

Tracey 🙂