Let’s be frank, and talk franking credits on dividends.

We are lucky in Australia, we have a lot of stable high-yield dividend stocks and quite a lot of them have tax benefits in the form of franking credits.

If you receive dividends you’ve probably noticed that they can be either fully franked, partially franked, or have no franking credits at all and be unfranked.

But what does that all mean?

The ‘franking’ refers to the tax credit that has already been paid on that dividend. Think of it like a small scale tax offset.

Companies in Australia are taxed on their profits at the company rate of 30%.

So when they give out their dividends (assuming the company pays dividends), then they can choose to pass on the dividend in full (where they haven’t paid any tax yet), or they can pay the tax on it (either fully or partially) and then pass it on to shareholders with the tax credit attached.

So let’s say the dividend payment is $100 (pretty sweet dividend but let’s go with it because the math is easier).

If no tax has been paid on it, the company will give you the full $100 payment. (There won’t be any tax credits obviously).

If the tax rate of 30% has been paid, you’ll get a $70 dividend payment and the other $30 is paid to the ATO. And you’ll get that $30 as a tax credit for when you put in your tax return.

And depending on your personal tax rate, it could even mean you get that back as a refund.

Imputation System (to prevent double taxation)

It’s all part of the imputation system to prevent double taxation.

Because what they don’t want to happen is that the company pays its share of tax on its profits, then the shareholder pays tax on it again as income. That’s taxing that same income twice.

So to prevent that from happening, if the company has paid tax on that before giving it to shareholders, they’ll get credit for that. When the shareholder has to put their personal tax return in, they won’t have to pay that portion of the tax (because it’s already been paid by the company).

So as I mentioned before, a dividend can be fully franked – that means the full tax rate of 30% has been paid already, and so the investor will get credit for that amount come tax time.

It can be partially paid, so while the full 30% hasn’t been paid, some of it has. They’ll tell you exactly how much franking is included when you buy the share, or when the announcement about dividend payments comes out.

Or it could have no franking at all, which means the company hasn’t paid any tax on it, so there would be no tax credits and you’d have to pay tax on it yourself when you put your return in.

Tax Time

So let’s say it’s tax time and you own shares in a company that pays fully franked dividends.

Now it comes down to your personal tax rate.

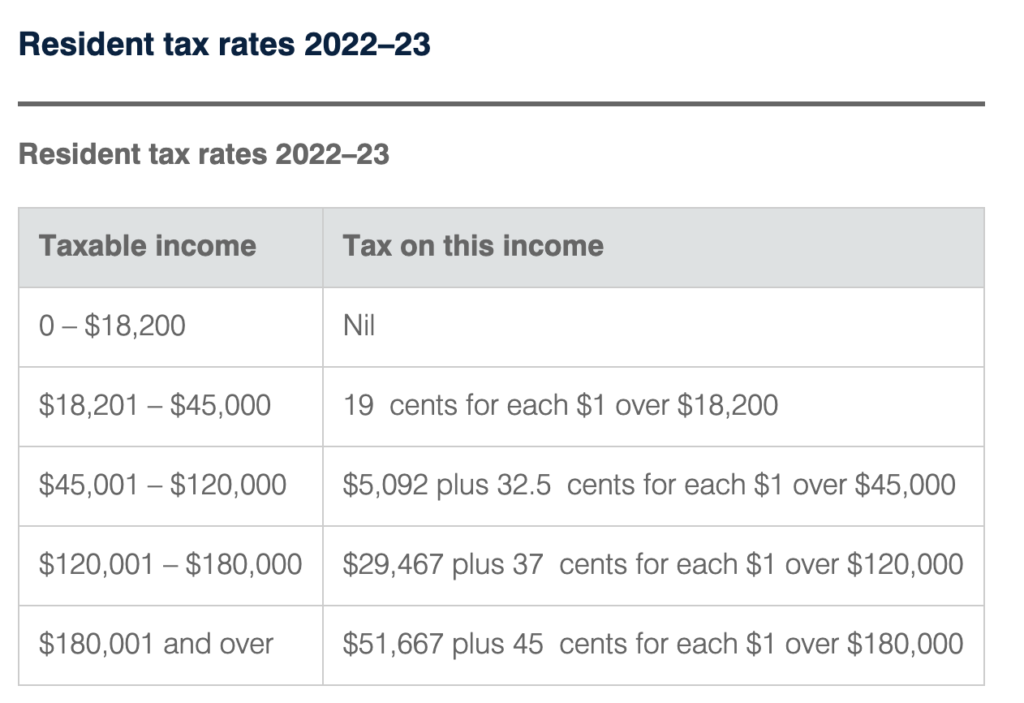

These are the current tax rates (2022-23) in Australia, depending on your annual income.

Let’s say your personal tax rate is 0%, you’re under the income threshold and aren’t required to pay tax. But you have received fully franked dividends (or partially franked).

Because of the tax credit, you will now receive that amount back as a refund. So that 30% that the company has paid, will now be given back to you since you aren’t required to pay any tax.

At the next tax rate, you’ll get a partial refund, since you’ll be required to pay some tax, but not the full 30%.

If your individual tax rate is over 30%, you won’t pay the first 30% from the dividend income, but will be required to the difference above that, depending on your rate.

If you are above the 30% rate, so 32.5%, then you only pay tax on the portion above 30%, which in this case is 2.5%.

If your tax rate is 37%, you’ll be taxed just the extra 7% on that dividend income.

And so on.

This obviously only applies to the dividend income, and not all your other income.

45 Day Holding Rule

So this is obviously awesome, but there are some rules that you have to follow to get the tax credit.

The most important is that you must hold your shares for at least 45 days to get the franking credits.

It’s actually slightly longer, 47 days because they don’t count the purchase date and the sale date.

That’s to prevent people who like to dividend strip. Dividend stripping is where you buy and hold the shares just long enough to get the dividend payment then sell straight after.

And you keep continuing to do that. It’s only a strategy that works in a rising market, because otherwise the price fall will offset any gains that you get from the dividend. But that’s another video.

So are fully franked dividends better than unfranked dividends?

Good question.

It depends. At the end of the day, whether you get the full dividend payment (so unfranked dividends), or fully franked dividends where the tax rate has been paid – you do get the same money, it’s just that in one instance you get all the income at once, and the second you get 70% up front, and they the other 30% benefit come tax time.

If you’re a long term investor franked dividends are beneficial (it’s why I like them), but if you’re a very short term investor or actively trading, it might not make as much sense or even matter all that much.