Is it 2015 already? Then it must be time that I listed my top shares for this year.

It’s been a strange year for the stock market. We’ve seen some companies reach historical highs, and some fall flat and die.

I only have three companies that fit my rules for this year, although I’ve listed another two below that which I still think are good companies.

To refresh your memory (even though I’m sure you know the criteria by now), the companies that made it through must have:

- Return on Equity – 15% or higher

- Earnings Stability greater than 80%

- Debt/Equity must be 75% or less

- and they should have above average returns over both one and five years. (I define above average returns as those that are better than the All Ords index returns).

What does it mean that only three companies made it?

Time to buckle up the belts and pull your boots on. We are expecting a storm coming over the next year or so. The past three years have been excellent for returns, but things will slow down and it’ll be harder to make easy money in the stock market this year.

It’s no time for panic, of course, but it’s good to be prepared. Holding shares is a long term game and I wouldn’t let a few bumpy years scare you away. Besides, when stock prices go down that means a big sale, and this girl loves a sale.

What are the results from last years picks?

You mean I actually have to prove myself that I know how to pick a good stock? Good grief. 😉 Just kidding. Here are my results:

AUB – -6.7%

CBA – 18.19%

DMP – 61.79%

ONT – -6.5%

PTM – 27.49%

SEK – 40.64%

TNE – 53.00%

So two fell and the rest rose (by quite a lot I might add). I just want to point out that I still like AUB and ONT as companies, so the fall isn’t enough for me to dump them. I’ve even included them as the two additional companies to buy in 2015.

Should I sell the companies that didn’t make this year?

Not my call, it’s up to you. A healthy profit is never a bad thing though 😉

Here are the companies for 2015

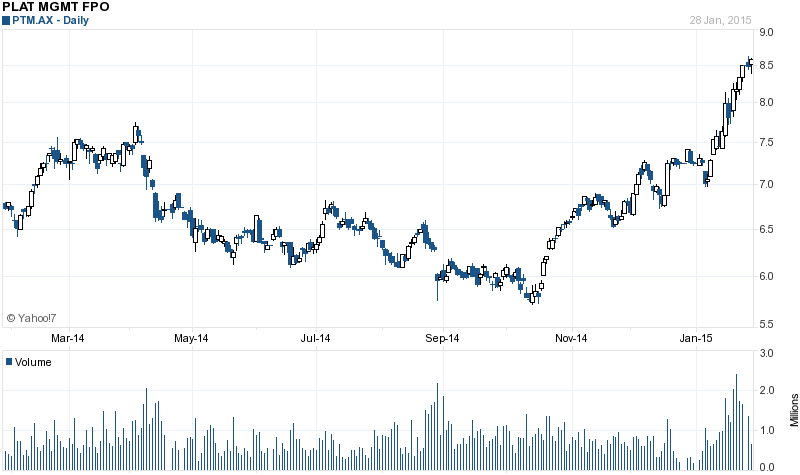

PTM – Platinum Asset Management Limited

- Return on Equity – 50.6%

- Earnings Stability – 82.4%

- Debt/Equity – 0.0%

- 1 year return – 12.6%

- 5 year return (p.a.) – 11.1%

- Dividend Yield – 3.1%

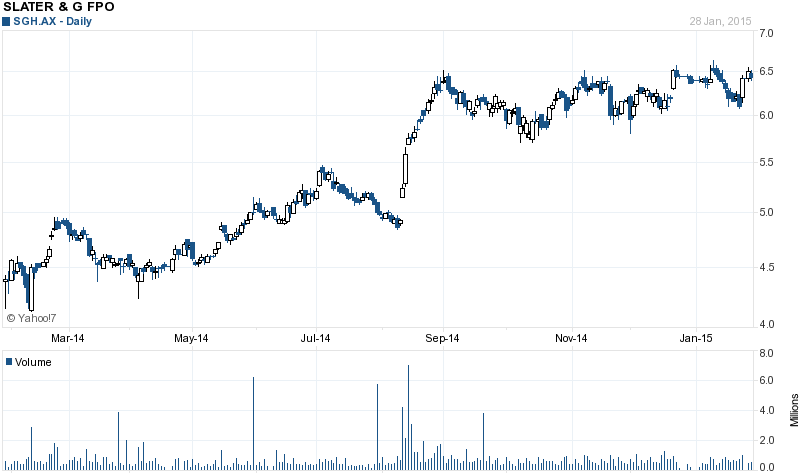

SGH – Slater & Gordon Limited

- Return on Equity – 15.1%

- Earnings Stability – 94.0%

- Debt/Equity – 29.9%

- 1 year return – 47.8%

- 5 year return (p.a.) – 36.9%

- Dividend Yield – 1.2%

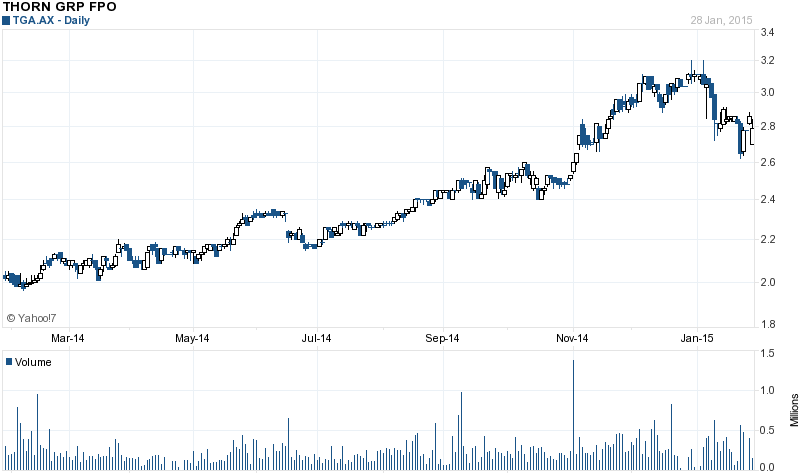

TGA – Thorn Group Limited

- Return on Equity – 16.4%

- Earnings Stability – 86.7%

- Debt/Equity – 23.6%

- 1 year return – 57.3%

- 5 year return (p.a.) – 27.5%

- Dividend Yield – 4.1%

And two more …

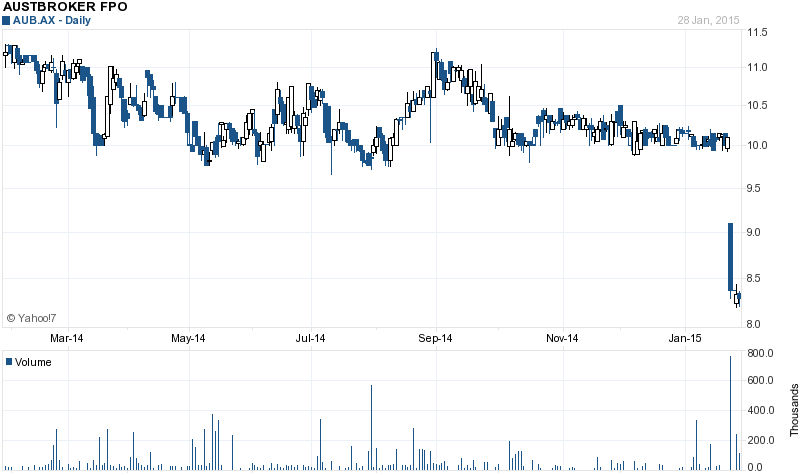

These two didn’t make the cut this year because their share price over the past twelve months fell, however they are still solid companies and strong candidates for your portfolio consideration. If you haven’t bought them yet, you might want to think about them as they are ‘on sale’ at the moment.

AUB – Austbrokers Holdings Limited

- Return on Equity – 15.4%

- Earnings Stability – 84.5%

- Debt/Equity – 23.5%

- 1 year return – -6.7%

- 5 year return (p.a.) – 19.6%

- Dividend Yield – 4.6%

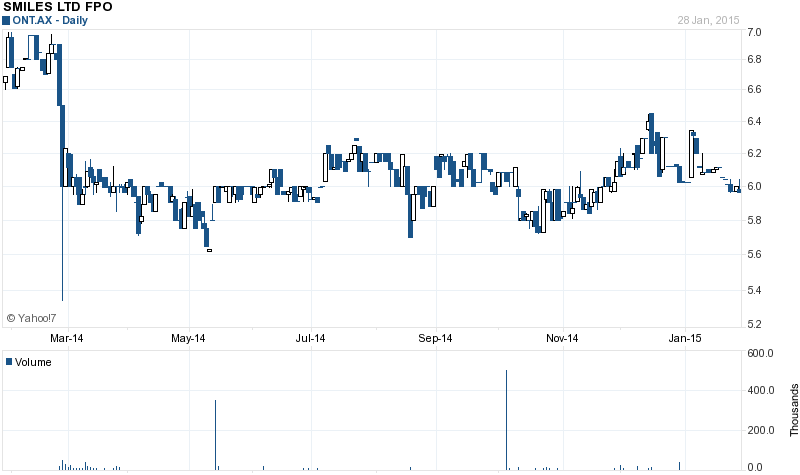

ONT – 1300 Smiles Limited

- Return on Equity – 17.1%

- Earnings Stability – 81.7%

- Debt/Equity – 0.0%

- 1 year return – -6.5%

- 5 year return (p.a.) – 22.3%

- Dividend Yield – 2.4%

Image Credit: All graphs are from Yahoo! Finance.

11 Comments

Hi Tracey

I have read your book and as a female investor it is always the easiest to understand.

I am interested to see your stock picks for 2015. Do you keep the profitable shares from last year? For example TNE had terrific capital gain for the year but its earning stability has decreased to 75%. So do you still keep it or sell?

Thanks Nicky

Hi Nicky,

If stocks don’t keep their fundamentals then I usually sell. While I can’t tell anyone what to do with their own portfolio’s (liability and all that), if I was holding TNE and made a great profit, and if now their earnings stability don’t fit my rules, then I would sell. 😉 Nobody ever went broke taking a profit.

Good luck with your investing!

Tracey 🙂

Hi Tracey. This may be an extraordinarily stupid question but where do you get your stats on the all ords? Last year you spoke of 9% & 11% but when I tried to run the statistics on the increase year to date I didn’t get the same percentages! I’m also finding it hard to let go of the stocks that have done well. Breaking up is so hard to do…(must be a female thing) so any tips you have on how to be hard headed in that regards would be appreciated. As always, thanks so much for your book and blog, they are inspirational. Keep up the good work. Kind regards,Belinda

Mostly the stats come from my excel spreadsheet. Could just be the dates that I take the figures that is throwing you off (usually grab them a few weeks before I actually write up the blog post) (Hmmm I did use this year’s figures didn’t I? Goes off to check). But use your own %’s if that helps because to be honest, the % increases aren’t as important as the stats: ROE, earnings stability, & debt equity. Those are the only ones I really focus on.

As to letting go of stocks that have done well, you certainly don’t have to. If they are still good companies then put them away for another year and revisit. Or set up an alert for if the stock price dips below 10% of it’s current price. Whatever works for you. I’m just ruthless I guess. You’re earnings stability has fallen? Oh well, onto the next company. (Luckily I’m not like that with men – LOL).

All the best for your investing!

Tracey 🙂

Is there any way we can subscribe to you so we don’t miss any future articles you might publish?

Thanks for sharing Tracey! I had a big sell up of my shares at year end (for a healthy profit thanks to following your rules). I enjoy a sale too, so I’ll keep my eye on the good companies throughout 2015! Thanks again 🙂

Awesome. Good to hear! Tracey 🙂

Hi Tracey,

How are you? Hope you are well, been reading some of your articles about stock trading and also wanted to start my stock trading and following your recommendation. But I can not start since I don’t know where to begin. Do you have like a guide on how to start and what broker to use for beginners like me. Hope you reply and thanks so much.

Carry

Woah this article blows! To those of you unfortunate enough to have “bought into” this bulls**t , I’m terribly sorry the the thousands of $$ you flushed away. Rename this article to “How to halve your portfolio in half a year” AHHAHA.

Would love to hear your picks for 2016! SGH and AUB have bombed….

Hi Tracey,

I have purchased all of your books and must thank you for making the share market so simple to understand and now a fun, enjoyable hobby. I hope you are busily writing another book (hint, hint). Just a quick question regarding the purchase of an index which you outlined p201 (SFS). I’m still having trouble understanding it but basically is it something you would invest in yourself ? If so, Which particular index ? or would that be dependent on funds ? I’m not even sure about what type of funds would be required for such an investment. Keep up the great work Tracey. Thankyou, Karen