When I started investing in the stock market, exchange traded funds weren’t a thing. We had managed (mutual) funds (*) that you could invest through a fund manager, or you had stocks of single companies that you invested directly.

(*) Quick note: Managed funds and mutual funds are the same thing. In Australia we call them managed funds, in the US they are called mutual funds. Just different names.

I was always attracted to managed funds. The idea of holding many different companies at once was appealing. But filling out paperwork and sending my money off to someone else to invest for me, was less so. I have control issues. Especially when it comes to money.

Still, I wanted in on this investing thing and dabbled in buying stocks. You probably know the rest of the story. I got hooked on the benefits of the stock market and I’ve been trading ever since.

But back when I was still getting started I knew that buying just one company wasn’t the smartest idea. Even with the best research into the company fundamentals, there were no guarantees.

Diversification (buying a handful of different companies) made more sense. But when you’re just starting out and only have a finite amount to invest, it can make diversification a little tricky.

Your dilemma: Do you put $10,000 into one company or $2,000 into five companies?

You have it better now than I did because diversification is easier. Exchange traded funds (ETFs) make it so much simpler to diversify your portfolio now. I think all beginner investors should start with ETFs.

Let me explain why.

The Pareto Principle

You’ve probably heard of the Pareto principle, also called the 80/20 rule. It applies to a lot of things, especially when it comes to business and finance. 80% of your results come from 20% of your work. Problem is that you don’t always know which 20% led to the results.

Personally, I don’t think that matters. Trying to figure out the 20% that works is a waste of time because that 20% is always shifting. What works today doesn’t always work tomorrow.

Same with shares. Here’s what I’ve found.

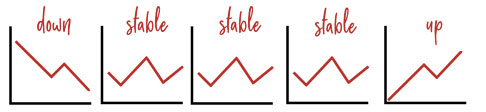

For every five or so companies that I invest in, one will rise, one will fall and the other three will kinda rise or fall, but really not do much at all.

In a rising market, the company that’s up will rise higher, the stable companies will rise and the down company will fall slower. You’ll make money.

In a falling market, the company that’s up will rise slower, the stable companies with fall slightly or stay the same, and the down company will fall faster. You will lose money.

In a stable market, the up and down company kinda cancel each other out and you rely on the smaller profits of the stable companies. You make money but at a slower steadier rate.

It’d be great if every single stock investment you purchased made you money. I truly wish it were that simple.

People say that doing research will help pick the winners (and it can help), but overall your chances of picking those rising stocks is only about one in five (and that’s in a good market). It’s great when you do, but it doesn’t happen as often as you think.

And what happens if you chose poorly and picked the falling stock instead? You give up and decide the stock market isn’t for you.

This is why you need to take the safer and less risky option and rely on the overall performance of your portfolio and not single stocks.

You need to diversify.

What are Exchange Traded Funds?

Quite simply, an exchange traded fund is a managed fund (usually an index fund) that’s traded on the stock exchange just like a regular company.

You buy and sell just like you would any other stock.

The ETF can have any number of stocks included in the fund. Generally, it’s between 50 to 100 companies included, depending on which one you get. There are many different types.

You can start easy with a simple index ETF that just tracks those companies in the particular index you like, or you might niche down and only get one with industrial stocks or just property stocks. You can also buy ETF’s that are only currency or bonds.

You can also stick to ETF’s that contain companies from your own country or choose one that includes companies from overseas., Actually if you did want to buy stocks from another country, buying into ETFs is a much easier and cheaper way to do that.

I know when I wanted to buy into some US stocks, which I did about ten years ago, the brokerage to buy and sell was crazy expensive, and in the end not worth it. Now I can invest in US stocks without the hassle.

The downsides

ETFs are great. Perfect for diversification. Excellent for beginners because they are easy. I think all beginners should start with ETFs when they are building their portfolio and once they get a feel for how the market operates (and gets used to the daily fluctuations of the market without freaking out) can then move on to buying shares individually.

But like everything, there are downsides.

The first is fees. All managed funds have fees and ETFs do too. You don’t pay the fee directly, it’s absorbed into the performance. ETF fees are usually much lower than regular managed funds though.

You’re buying and selling on the stock exchange. While that can be an upside too (I personally prefer buying this way) it does mean that you are subject to the regular fluctuations of the stock market as a whole. Each day the price you buy (or sell) is different than the day before based on market sentiment for that day.

And lastly is control. Because you are buying into a fund that a fund manager has put together, they’ve chosen which stocks are in that ETF. Sure you can look around and choose an ETF that aligns with your goals, but you are still buying a parcel of shares that someone else has chosen. (Although beginners might also find that to be a pro as well. Especially when they don’t know where to start).

So that’s it.

My guide to why I like Exchange Traded Funds (ETFs) and why I think all beginners should start with them in their portfolio. They are simple and most importantly offer great diversification.

In my next post, I’ll go over if you can get rich with ETFs and how to build a good ETF stock portfolio that suits your goals as an investor.

Catch you then,

t 🙂