Now that you’ve got your savings account set up, it’s time to fast track your savings so that you can get to your goals sooner.

Now that you’ve got your savings account set up, it’s time to fast track your savings so that you can get to your goals sooner.

In this post, I’m going to cover ways to do that through automating how much you save, giving yourself savings challenges, and finding extra money to boost your savings.

Let’s start with automation.

Automate your savings

An easy way to get your savings rolling is by setting up an automatic transfer from your regular account to your savings account.

This can be set up on the day that you get paid, or any other timeframe that works best for you.

By setting up an auto payment it means that you save time and mindspace – it’s one less task that you have to think about.

I’m a fan of putting as much of your finances on autopilot as possible. Bills, savings, paying debts etc.

It frees up time to get on with living your life and isn’t that the whole point.

Steps to Automate your Savings

So how do you do it? First, decide how much you’re going to regularly transfer into your savings account. I’d say choose a figure that slightly lower than what you think you can save. If you have budgeted to save $400 a month, then make your auto transfer $300 a month.

You can always add the remainder at the end of the month. I like having the auto transfer a little less so that I don’t have to worry about not having enough in my bank account.

There have been times where I’ve set up automatic bill payments that I’d forgotten about and I’ve gotten close to not having enough in the account when savings came out. (Now I always have a buffer of at least $500 in my account and don’t let it dip below that).

Next, you need to determine which day of the week or month that’s the best to do the automatic transfer. If you get paid on a specific day, make the auto payment a day or two later (again, just to make sure that the funds have gone into your account correctly).

You can set up automatic transfers and payments through your banking app.

Round-up Features

Another way to automate your savings is to set up a round-up feature based on your spending.

The basic concept of a round-up feature is that it ’rounds up’ whatever you spend on your credit or debit card to the nearest dollar and places the difference into an account.

So if you spend $6.25 on a purchase it will round up the purchase to $7.00, placing the difference, in this case, seventy-five cents, into a specified account.

There are a few different banking companies coming on board with this, ING has been advertising it heavily recently. The major banks haven’t started this yet although I suspect they will in the future.

The way I utilize the round up feature is through the Acorns app.

Acorns

With the Acorns app, the difference gets deposited into an Exchange Traded Fund (ETF) rather than a regular savings account. ETF’s are my favorite way to get started investing in the stock market.

With the Australian Acorns app, you can choose between six different ETF’s based on your risk threshold. The first five being: Conservative, Moderately Conservative, Moderate, Moderately Aggressive and Aggressive. The sixth, Emerald, invests in socially responsible companies (it’s the one I chose).

It isn’t free though.

Balances under $5,000 attract a $1.25 fee per month. Over $5,000 and it’s 0.275% p.a. based on your balance. That’s not unreasonable compared to other ETF fees, however.

Acorns in the US have similar fees.

So while you can potentially earn more than a regular savings account, if you have a small balance, those fees can eat away any gains. For that reason, it’s only worth using if you can keep a balance over $300.

I also wouldn’t keep more than $10,000 in it. If your balance gets that high, take some out and put it directly into the stock market.

Of course, you can also do this yourself by tracking your spending and putting the extra into your savings account yourself, although that wouldn’t be automated.

It’s a very similar concept to putting your spare change in a jar each day if you use cash, and then taking the jar to the bank once it gets full.

Savings Challenges

I always tend to push myself when there is a challenge involved. I think that’s the same with most people (and why gamification works so well).

So I did a quick search around for some easy and fun savings challenges that you can do.

These challenges were my favorites. There are plenty out there to choose from. Scour Pinterest, blogs, or Facebook groups to find your favorite or incorporate one of these below.

Are you up for a challenge?

The 52 Week Savings Challenge

Okay, you’ve no doubt seen this one before. It’s pretty much the first challenge that comes up when you search for savings challenges. There’s a good reason for that. It’s simple and it’s achievable.

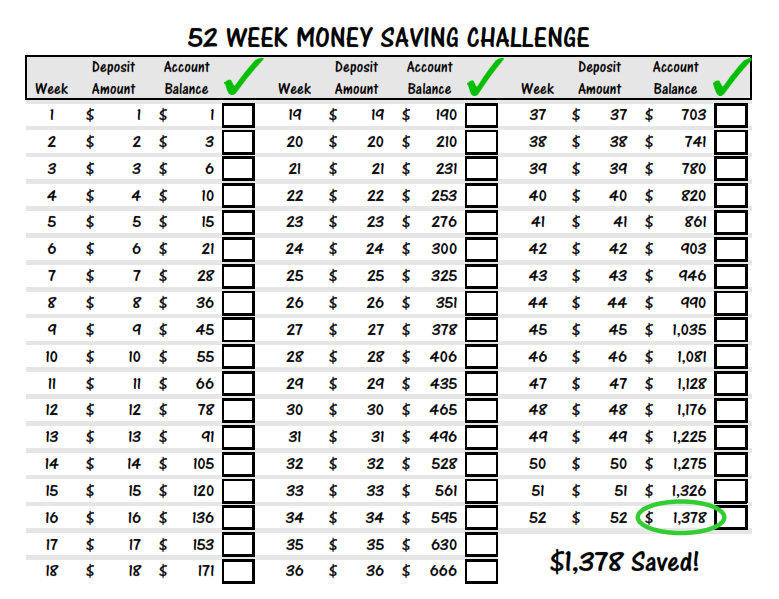

If you don’t know, the idea with the 52 weeks savings challenge is that you start by saving $1 in week 1 and then each week you increase the amount of money by an extra dollar. So in week 2, you save $2. Week 3, $3 and so on, right up to Week 52, saving $52.

The amounts aren’t a lot, but it shows the power of regular saving, even small amounts, can add up fast. By the end of the challenge, you would have saved $1,378 over the 52 weeks.

You are meant to start the challenge at the start of the year and finish at the end. But you can start whenever you like.

Week 1 doesn’t have to be the first week in January, it can be the first week after your birthday, or next week. It doesn’t matter when you start.

This can also be done in reverse, starting with saving $52 in the first week and then working back to $1 in the last.

Many people prefer doing it in reverse as it’s easier to save more at the beginning because motivation is high. Also if you are putting your money into a high-interest account, putting the higher amounts first means you’ll earn more interest overall.

Here’s what it looks like:

Save Your Fives

This challenge might be new to you.

The Save Your Fives money challenge is where every time you get a five dollar note you add it to your savings.

How it works.

Let’s say you buy something with cash and hand over a twenty and get a five dollar note and some coins as your change.

Sock that five dollar note away and keep it safe. You can’t spend that fiver now because it’s going into your savings.

Do this each and every time you are given a five dollar note, either as change, finding it in the street, or whenever you stumble across one.

Why fives?

Five dollars a smallish amount so it’s not so intimidating. But it’s also large enough that you’ll see a dramatic difference in how much you can put away.

It’s entirely possible to do this with your one or two dollar coins (or notes) if you prefer, but doing it with a fiver means your savings will add up much faster.

This challenge does mean that you’ll need to commit to using cash rather than your card for smaller purchases. Otherwise, those five dollar notes won’t come as fast, and that’s kind of the point of the whole challenge.

No Spend Month / Week / Year

I’ve talked about how I try to do a no spend month once a year. If you want to try your own no spend challenge, it can be a fun way to work out your relationship with money and see how easy (or difficult) it can be to cut down.

We don’t need as much stuff as we buy, and doing a no spend really brings that mindfulness to our spending habits back into focus (and can help save a lot of money while doing it).

Spending equals Savings challenge

The Spending Equals Savings challenge is where you match any discretionary spending you do and put the same amount into your savings account.

How it works

Let’s say you want to buy a small indulgence, say a fancy coffee at a cafe, and it costs four dollars. You can buy it for four dollars, but you also have to match that by putting four dollars into your savings account.

Each time you make any discretionary purchases, you match it and put the same amount into your savings.

$10 book = $10 into your savings. $50 drugstore splurge = $50 in your savings. And so on.

Not only is it a good way to build your savings, it’s also a good way to keep track of your spending. Because if you can’t afford to put the same dollar amount into your savings account, perhaps you can’t afford that item after all.

Lump Sum Savings

Another good way to boost your savings is to put any lump sums, tax refunds or windfalls that you weren’t expecting, into your savings account.

The average tax refund in Australia according to the Australian Tax Office (source: https://www.etax.com.au/average-tax-refund-sept-12/) is more than $2,300. It’s a little higher in the USA, with the average taxpayer receiving $2,700.

Let’s average that out to $2,500 a year and see what just saving that amount and placing it into a savings account at 2% p.a. would be. For this example, I’ll say that you don’t have any extra money to put into savings, your refund is it.

I’ll also use the example of the account only paying interest on the final balance for simplicity, but do know that most accounts pay interest on the daily balance so your actual return will be slightly higher than I’ve put here.

- End of Year One: $2,550 (you put in $2,500 and earned $50 interest over that year).

- End of Year Five: $13,270 ($12,500 of your money, $770 interest, over the past five years).

- Year Ten: $27,922 ($25,000 of your money, $2,922 interest).

- Year Twenty Five: $81,677 ($62,500 of your money, $19,177 interest).

The longer you leave it in, the higher the amount of interest you’ll receive over the lifetime of that account.

I love compound interest.

Purge & Sell

You might have already done this when trying to get out of debt, but if you haven’t (or you skipped that part because you have no debt), then read on.

You can fast track your savings and provide a great initial boost by doing a big declutter of your current belongings and selling those items that have worth.

Start room by room so you don’t become overwhelmed and pull out everything that you no longer use or want.

Place all of those items somewhere where you can see them, a floor or table is good. Then see what you have that you could sell.

Bundling items works well for similar items like books or DVDs, rather than selling them individually (and you get can get rid of them in one fell swoop). You can list your items on places like eBay, Craigslist, Mercari or Facebook sell and swap groups.

Make sure to factor in postage costs (which the buyer pays) and you can get rid of all your unwanted stuff and make some serious cash, all in one go.

Power tip: this works on large items too. Downsizing to one car instead to two, getting rid of the jetski you only use once a year (it’ll be cheaper to hire one than own if you only use it every so often).

Other ways to find extra money

A lot of the other ways to find extra money I’ve already talked about previously.

Things like starting a side hustle to earn extra income, or ditching the car and biking or walking everywhere.

Living a simpler life is a great way to de-stress and build your savings at the same time.

I hope you’ve found some ideas and inspiration with the challenges and ideas I’ve included.

It isn’t always easy to commit to building up your savings, but if you want to become financially independent you need to have money building up.

Always be saving. Your future self will thank you.

From the author

Did you find this article useful? It’s actually part of the first draft of a general finance book I’m writing. I’ve decided to blog the book (that is, write the first draft of the entire book on this blog as I go.)

The blog posts might not be in order as I skip around different sections of the book, and not everything I write may end up in print. However, it’s a good strong base for what you’ll find inside.

That means you can watch me write it, and even read the book for free (a few thousand words at a time) if you like.

Or if you want to get notified when I publish it, you can sign up to my email list below (I’m only sending out emails once the book is done and I don’t know how long that will be).

Until the next post, happy reading.

Tracey 🙂

[mailerlite_form form_id=1]