Dividend stripping, also called dividend capture, is a strategy whereby you buy shares in a company just for the dividend. You buy before the ex-dividend date, and when the company goes ex-dividend, you sell the shares, either on the ex-div day or a few weeks later.

The reason you want to consider using it is that you get the full dividend payout, even though you may have only held the company for a day or two.

It’s a short-term income strategy. And not one recommended for beginners or those playing the long game.

It’s also not something you want to do with every stock you buy. But when you used correctly, as I’ll go over in this article, it can reap some quick cash rewards.

Is it legal?

Right now you might be asking yourself, is this allowed, can you really only hold the shares for just a day to get the dividend?

Yes, it’s perfectly okay to do so. But there are some rules and other things you need to be aware of. And while it’s possible, it’s not always advisable to hold for such a short period in certain situations.

Let’s look at how to get the best out of this strategy.

First, let’s understand the 45-day rule.

In Australia, to stop blatant dividend stripping whereby investors would buy the day before and sell on the ex-div day, they implemented a rule whereby if you want the franking credits associated with the dividend, that you need to hold the stock for at least forty five days.

I believe there is a similar rule in the US that’s for 60 days.

The franking credits (or tax credits) is the tax already paid on those dividends by the company. If the stock is fully franked, the company has paid the full company rate of 30% on that so at tax time, that amount either reduces the amount that you have to pay and if it’s more than the tax you owe, you get that money back as a tax refund.

Let’s just say I’m a fan of fully franked dividends.

Ok, does that mean you should hold for 45 days then?

Not necessarily. It depends on a few things.

Firstly, this rule only applies to companies that have franked dividends. If a dividend isn’t franked, like Stockland, then you don’t need to worry about it. You can hold for as little or long as you like because there are no tax benefits to gain here anyway.

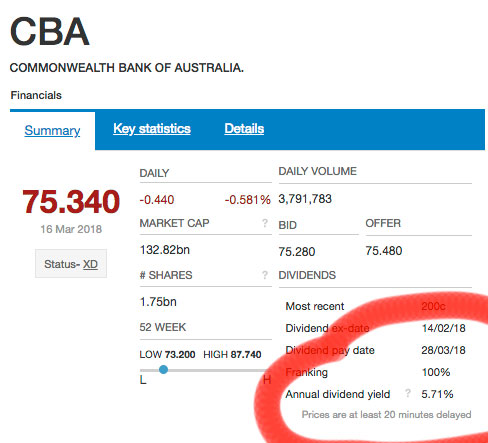

If a dividend is franked, like Commonwealth Bank, then if you want the tax credits, then yes, you do want to hold for at least 45 days to get it.

But maybe you don’t care about the tax credit. You can still buy whatever shares you want, for however long you want, if you don’t care about the tax saving. That’s up to you and your situation and your goals.

Because whatever strategy you implement will also depend on the share price too.

So, let’s talk about that.

The main dividend dates and the effect on the share price.

The usual pattern of dividend reporting goes like this.

The Announcement Day

First, we have the announcement day. Also called the declaration day. That’s the day the company releases a statement to the stock exchange and the shareholders of when it’s going to pay its dividend, when the ex-dividend day is, and how much the dividend is going to be.

Okay, so usually what happens on announcement day is that people who are looking to buy for the dividend start purchasing the stock. And if we’re in a rising market (like we are right now), or even a flat market, the stock price begins to increase.

Record Day

There’s also the record day, but you don’t need to worry about this one. It’s just for the company to make a record of who is getting a dividend payout.

The Ex-Dividend Day

The stock price generally rises in value until the ex-dividend day hits. The ex-dividend day is around two to four weeks after the announcement day and is the day when you don’t need to hold the stock anymore. You’ve got the dividend, all is good.

On the ex-dividend day everyone that’s only bought for the dividend wants to sell, and, as you expect, the price falls. In a perfect market, the stock price generally falls by around the same as the value of the dividend, so all things being equal, there has been no gain or loss, you’ve just sacrificed the value of the share price for the dividend income you’ll receive.

But as we all know, it’s never a perfect market. Sometimes it doesn’t fall as much, sometimes it falls more. You just never know what it’ll do.

The Payment Day

Okay, so now we get to the payment date. This is the day that the dividends turn up in all their loveliness into your bank account (or the day you get sent a cheque if that’s still your jam). The payout date can be anything from around two weeks to two months after the ex-dividend day. All companies vary on when they pay out. Time of year matters too. End of year often means waiting longer for your dividend payment.

So that’s generally the way it goes.

You need be aware of the general pattern of the share price if you want to implement a dividend stripping strategy.

There is no use buying at one price and getting the dividend if you then sell the stock back at a loss that’s greater than the amount of the dividend payout.

How long does it take for the share price to recover?

The best scenario that you want to aim for if you’re dividend stripping is to sell once the share price has recovered. That way you’re not losing out on the value and you’re picking up the dividend without any other losses.

Sidenote: Sometimes taking a loss on the stock price isn’t a bad idea if you want to use the capital loss to offset tax. This is generally only a good idea if you’re in the highest tax category. I don’t worry about this personally as I’d rather take a profit than a loss (but I don’t have a high paying job so the tax situation doesn’t apply to me anyway). Your situation may be different.

Each company is different as to how long it takes for the share price to return to the same value as when you bought it. Sometimes it can recover within days, sometimes it takes weeks or even months.

It also depends on when you purchased it too.

If you bought on the day before the ex-dividend day, you probably paid a higher price than if you bought before the announcement day (before all the other investors starting jumping in).

So how can you implement this strategy and not lose on value?

First and foremost, dividend stripping won’t be profitable in a falling market. This strategy works best in a rising market, but can still be okay in a flat market too. But if the market is in decline, don’t try this, you’ll get the income but you’ll lose overall as the share price continues to fall. That’s not what you want.

Don’t try this strategy in a falling market.

If you can, buy before the announcement date. You can go and check online the approximate dates of the company dividend payout’s for the previous year. It’s generally around the same, give or take a few weeks. That way you can buy before everyone else.

The con’s of this is that you don’t know the exact dates yet, or the amount of the dividend, but it can be a good way to lock in at a reasonable price before it starts to rise.

If you want to buy after the announcement date, try to buy as far away from the ex-dividend date as you can. The earlier the better.

Wait until after the ex-dividend date.

Once the stock goes ex-dividend then wait. You’ll need to wait at minimum forty-five days (not counting the actual day you bought) from the date you purchased anyway if you want the tax credits (if the stock has them).

Wait until the price rises again to around the same price that you purchased it for, give or take. You want to consider brokerage costs here too.

Here are two examples. One that would have worked perfectly, and one that wouldn’t.

As you can see from the two charts, RIO would have been an excellent candidate for dividend stripping. It went ex div early August 2017, and the price recovered within two weeks. If you had purchased at the announcement date and sold approximately 45 days later, then you would have got the dividend and made a profit on the price rise.

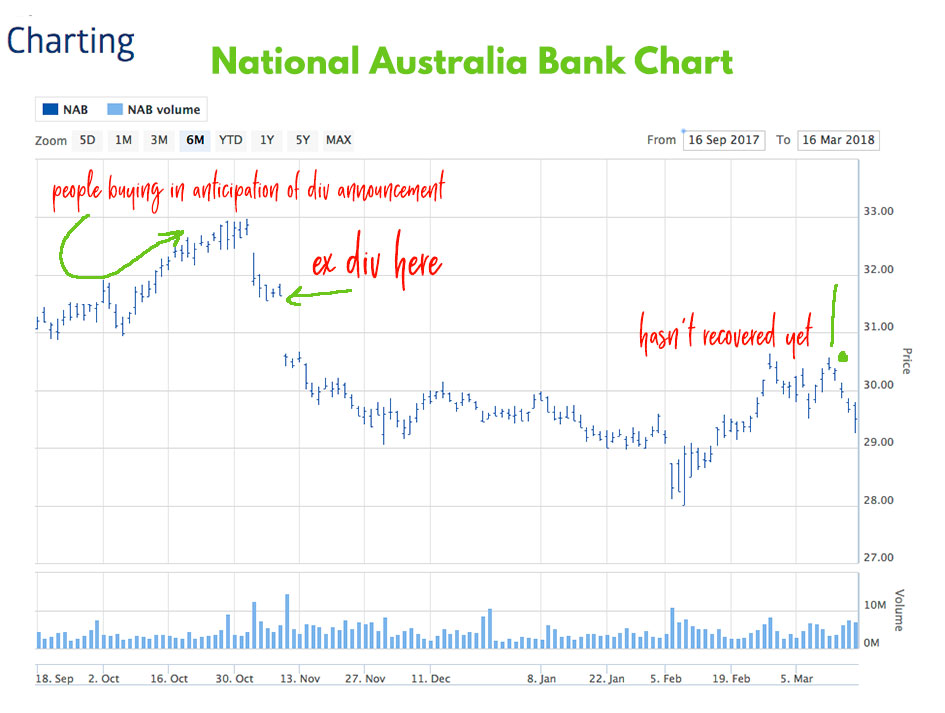

NAB wouldn’t have worked. There was a lot of anticipation and buying before the announcement date, but once the announcement date came, investors weren’t happy.

It didn’t rise as usual during the period between the announcement and ex-div day at the end of October 2017. In fact, the price fell instead. Not a good sign. Then there was another dramatic fall after it went ex-div and the price has not yet recovered.

NAB isn’t a bad stock to own, I quite like it overall, but it’s not a candidate for dividend stripping.

How to choose a company to dividend strip

So how can you choose a good candidate for dividend stripping?

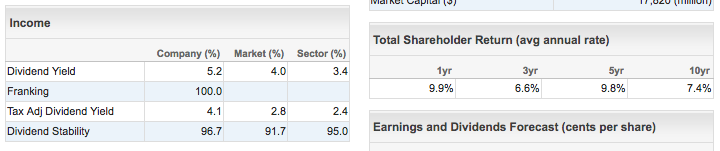

First, you want to choose a company with a high dividend yield. The reason that you want a strong dividend yield is that it can mitigate any losses that might occur if the stock price doesn’t rise as quickly to the price you paid for it. Essentially you can still take a loss on the stock price if the return on the dividend is high enough to cover that and still make you a profit.

Second, only look at largest capitalization stocks in the stock exchange. That’s the ASX200 if you are in Australia or the S&P500 in the US, and so on. You don’t want to try this on unknown companies as they are too unpredictable.

Third, look at both the dividend stability and the stock price of that company over the last twelve months.

If the dividend stability is over 90% then it’s a good candidate for taking the dividend. Check the chart to make sure that the company is in an uptrend. If so, it’s a positive sign.

Of course, all those signs are great markers for long-term yield stocks as well. Decide beforehand what your strategy is going in. Are you buying this for a quick dividend profit or long-term income? Don’t change your strategy halfway in.

What’s a good timeframe to hold?

I like a time frame of around 60 days, give or take. It weeds out those buyers who were hanging out for the forty-five day rule. They’ve gone, and it’s a time frame that I find satisfies any rules. And long enough that, hopefully, the stock price has increased again so you can sell at the same price (or slightly higher) than you bought it for.

And you’ve probably got the dividend within that time frame too, which is nice.

Or you might decide to wait longer. Perhaps even for the next dividend payout. Depends on the stock, the stock price, and whether you want to move your money into another div paying company and repeat the process.

That’s it. The simple steps to implement a dividend stripping strategy. I hope you found this article useful and it serves you well in your investments.

Happy Investing,

Tracey 🙂

P.S. I also made a quick video on this topic over at Youtube.