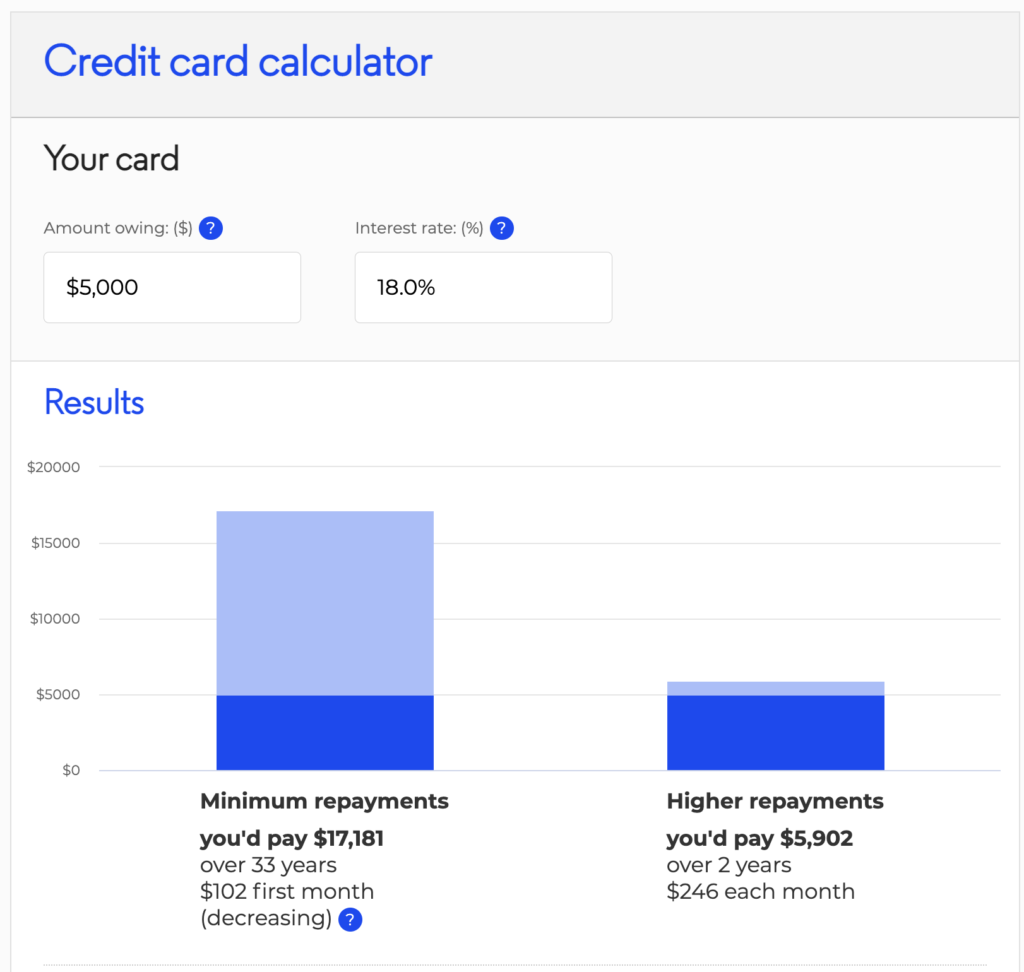

If you have $5,000 in credit card debt and you only pay the minimum balance, it will take you 33 years to pay off. That’s longer than a normal home loan.

And, you would have spent over $17,000 based on an average interest rate of 18%.

If you have a $10,000 credit card debt, paying the minimum balance will take you 43 years.

And if you have a $20,000 credit card debt, just over 54 years. Yikes!

So what can we do about this?

In this article I’m going to cover:

- The only time paying the minimum balance is okay

- Why you should think twice about balance transfers or opening more credit (debt trap)

- How to set up a plan to pay off your debt and make it a priority.

When should you pay the minimum balance?

We can all agree that paying the minimum balance on your credit card is crazy. You’ll never become financially free until you get out of debt.

There are only two situations that it’s acceptable to pay the minimum balance.

The first is if you have more than one debt and already have a plan to pay another one off first. You pay the most you can on the debt you are prioritizing until it’s paid off, and the minimum on the rest of your debts. Then you pay the most amount on the next one and so on until they are all paid down.

That’s a good strategy, as long as you focus on at least one of your debts.

The second reason should only be a temporary measure if you don’t have the money right now. Usually, because an emergency has come up and you need to free up cash for that situation. It’s a short-term situation only.

If this is the case, create a date and a plan in place for when you’ll return to paying the largest amount that you can. Because if you’re not careful, months will go by which will extend the time and the amount you’ll end up paying.

And, it’s not only the extra time and money you need to be careful of, you also need to ensure you don’t fall into a debt trap.

Debt Traps

What is a debt trap? A debt trap is when you get in a situation where it’s become too difficult to pay off all your debts.

Once you’re in a debt trap it can be super difficult to get out of.

While singles can fall into debt traps, it more often happens with couples or families. And older people too who aren’t able to enter the workforce and find a job to pay off any debts.

Generally, there are two main risk areas where someone can fall into a debt trap:

- First is the single person or couple that have a good salary. They might take out loans or credit cards because they can more than afford to make the repayments. Then either one (or both) might lose their job, get sick, or decide to start a family.

Now they are down to one income, yet their expenses remain the same as when they had more money coming in. They believe the situation is temporary so don’t worry about the higher bills during this time. They assume that soon/in the future, they’ll have the money to pay it back.

And sometimes that doesn’t turn out to be the case.

- The second situation is those on low incomes who are living paycheck to paycheck. It’s a struggle to keep up with general living. They are more vulnerable to offers of instant cash loans, payday loans, and the like.

Older adults are particularly vulnerable to this situation. Especially if they have increasing health problems and limited work prospects. Often people in this situation will start a cycle of opening new loans to pay off the first debt. Or apply for interest-free period credit cards to try and get things under control. Or even short-term loans to cover a repayment they have to make.

And they often end up with more debt than they began with and no way to pay for everything. It becomes a game of cycling one debt to another.

They’re trapped in this debt cycle that can sometimes be impossible to get out from.

So is consolidating your debts bad?

Not always, but you should think about whether it’s right for you.

Transferring your debts to one low or zero balance card or personal loan can be beneficial. But only if you use the grace period to buckle down and pay everything off as fast as you can and don’t make any new debt.

If you can do that, and you cancel all your other cards then it can work like it’s supposed to.

Many of these offers have expensive fees, or the low/zero interest rate won’t apply to anything new you put on the card. Once the grace period is up it’ll revert to a higher interest again. And many of these cards have very high-interest rates (more than a regular card). If you aren’t diligent you might be worse off in the long term.

Plus they also might mess with your credit score if that is something that you care about.

Personal loans can be better because the interest rate isn’t as high and they have a set period. Do check the contract though. See if you can pay off the loan faster without incurring penalty fees.

Read everything your sign and understand your rights.

You don’t want to be in a worse situation than you started from.

So how can you avoid the possibility of falling into a debt trap or paying loans for the rest of your life?

Build a Debt-Free Plan

You want to be as anti-debt as possible. I know people are going to say that you can use debt to your advantage by leveraging it to increase your wealth. Yes, you can. Especially with property or businesses.

But we all know that’s NOT what I’m talking about here.

Many of us are becoming financially savvy and understand our finances better. And so now the shift is leaning toward less credit card debt, but there is still a way to go.

You already know that if you are relying on debt to fund your lifestyle it’s a very risky and expensive strategy. You can’t predict what will happen to your life in the future and your ability to pay your debt back.

So if you are in debt and want to get debt-free (the best way to live) you’ll need a quick plan to pay it off.

Do this:

First, change your mindset. Change your thinking around spending, saving, and investing. You want to be anti-debt, frugal, and put as much of your money as you can into building wealth. The best thing to buy is income-producing assets. Assets that will give you money back and grow over time.

I have no debt, I’m pretty frugal and I put all my spare money into the stock market. The stock market produces income for me. You might do the same with an investment property, a business, or whatever builds your wealth. I like the stock market because it’s extra passive though. Once I buy a stock I don’t have to do much else except wait on the dividends.

Changing your thoughts first IS going to change your actions.

Next, set up your plan.

- Work out how much debt you have. You can use a spreadsheet or whatever you like to track your money.

- You want to pay as much of your income towards debt repayments as you can afford. If you haven’t already, start a budget. I’m a fan of personal budgets that track your income and expenses. I track everything. That way you can see where your money is going.

- Lower your expenses as much as possible without making yourself miserable.

- And avoid creating any more debt. If you have a problem with credit cards then consider switching to a debit card (or using cash only). I’m actually not someone who likes using cash because I find it hard to track. I do have a credit card because I find it easy to track spending that way, but I pay it off in full every single week. Every Monday add to my budget spreadsheet what I’ve spent and pay off any credit card balance. I never pay interest.

- If you want to keep your credit cards, decide which ones to keep and which ones to get rid of. You usually don’t need to keep more than one or two. It’ll depend on how you use them to which ones you keep.

- For the cards you plan on discarding, pay them off, then cancel them. You don’t want to have them there and tell yourself that you won’t use them. Cancel so you’re not tempted to use them again one day.

- It’s always fun to have a little ritual to destroy them too. Have a little ‘get out of my life’ party when they are gone. Oh but don’t burn them, because plastic smells terrible when it’s burning. But cutting into tiny pieces is always enjoyable.

Debt is awful. If you have it, you’ll never be free. The bank will own you for the entire time you have that loan or debt. You’ll also always have to have a job or income coming in so that you can afford your bills.

Don’t fall for it.

Do everything you can to be anti-debt and financially free.

You can do it.