There was a time not too long ago, shortly after I’d had my second child, that money became tight. This was something new to me as I’d always been pretty good with money. But life with a mortgage, rising utility bills, and now two kids to look after, left us living paycheck to paycheck. But I got myself out and you can too.

There are six steps that you need to take to get yourself out of the paycheck to paycheck cycle. The first step is to start tracking your spending and your income, the next step is to create a budget, the third step is to cut back on any unnecessary spending, the fourth step is to start paying off your debts, step five is to start saving for your emergency fund and step six is to save for those yearly expenses. Once all six steps are in place you’ll be in a far better place financially and can work on getting ahead even further.

Okay, so where do you start?

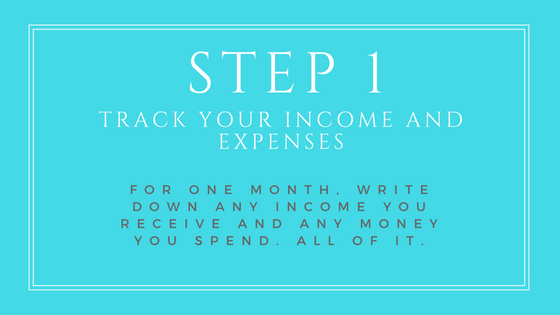

STEP 1: TRACK YOUR SPENDING & INCOME

You need to take an honest look at exactly how much money is coming in, and how much is going out.

Many people think they know or have a good estimate, but very few people actually write it down somewhere.

Tracking your expenses and income is also the first step to building a working budget for yourself.

At the end of every week, I make sure I enter everything that I’ve spent, or any income I’ve received, in a spreadsheet on my computer.

You can group items into categories, such as ‘entertainment’ if that works best. I try to group like items together. All my grocery purchases go under my ‘food’ section for example. And I have a separate section for take-out, just so I can track how much I’m spending there.

Use whatever you have to track your spending. That might be a spreadsheet like Excel, or the free Google spreadsheets. Or you might prefer to write it down on paper in a journal and keep records that way.

Doesn’t matter how you do it, just keep it simple, and something you’re likely to stick with.

After a month you’ll have a really good picture of where you are. You won’t need to guess, because you’ll know.

Now you can craft your actual budget.

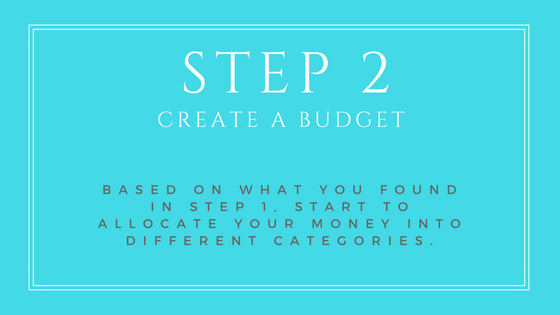

STEP 2: CREATE A BUDGET

Most people are scared of budgets because they think they’ll be restrictive, but I don’t see budgets that way.

A budget is just a tool so that you can allocate what money you have to your different expenses and start to plan where the extra money is going to go.

You can, and should, still give yourself discretionary spending, but how much will depend on your current financial situation.

After tracking your income and expenses in either your spreadsheet or journal, after a month you’ll be able to allocate where your money is going based on your lifestyle.

STEP 3: CUT BACK UNNECESSARY SPENDING

Your first priority is to look at your budget and see if you can cut back anywhere or make swaps for less expensive alternatives. Start with those items that aren’t necessary. You’re going to cut them for now. So if you always buy a takeout coffee, you’re going to start making your coffee at home instead. Start making your favorite meals at home instead of getting take-out.

This is not about eliminating all the fun things that make life interesting, it’s about either finding cheaper (but still satisfying) alternatives or holding off on purchasing those extras for a while until you’ve got yourself back on track.

You’ll be surprised at how just making a few changes, will free up some extra money.

Once you’ve gone through the easy stuff, you can start looking whether you need all the other expenses you think you need. Some will be necessary (like I couldn’t live without internet access for example) but some won’t – I recently gave up a gym membership and now workout at home using videos from YouTube.

STEP 4: PAY OFF DEBTS

Next, determine what debts you have. Your second priority will be getting rid of those. The debts I’m talking about is the credit card debts, the car loans, personal loan, etc. Not your mortgage or business loan (if you have one).

With the cash that you’ve freed up by changing your spending earlier, you’ll start to pay down those starting with putting the most on the smallest balance and the minimum on the rest.

This method, called the Debt Snowball Method by Dave Ramsey, is my favorite way of paying off debts because paying off the smallest balances first means you lower the number of debtors you have and it’s really motivating when you get to cross a debt off your list.

Keep concentrating on your debts until you get rid of them all.

STEP 5: START AN EMERGENCY FUND

Once your debts are gone, you can start saving. I actually don’t think you should start a savings fund until you’ve paid off your debts. Simply because the interest you pay on your debts will negate any gains you get from savings. And once you’re debt free – you can really start to make some serious financial gains.

Your emergency fund should be the first thing you save for.

I don’t think you need a large sum here. Emergency funds are for emergencies such as car repairs, a new washing machine, and so on. For most people, somewhere between $500 and $2000 is enough to cover those expenses.

STEP 6: START A YEARLY EXPENSE FUND

After you have your emergency fund, the next thing is to open a high-interest savings account (if you don’t already have one). Something that you’ll earn interest on your money.

Here you should start to build up savings for those yearly expenses such as Christmas, the yearly car insurance payment and so on. You can choose to place a set amount in here (say you need $2000 a year to cover those ‘extra’ expenses), or, what I prefer, is to just keep adding to your savings account until you have more than enough to cover all your yearly extra expenses and birthdays and the like.

Once you’ve got a really good savings amount saved up you can start to look back at where you started and know that it was all worth it.

Whether it takes you one year, two or five. You can change things around. You’d be amazed at how much you can change your financial situation for the better in just one year with commitment and believe in yourself.

You can do it. You can stop living paycheck to paycheck. It’ll be hard work, but it’ll be worth it.