When I started my investing journey many years ago now, I started the way most people do, and that’s looking for well-known companies and waiting for them to rise in price bringing me great riches along with them. Easy, right?

Of course, dreams of easy money are just that—dreams.

I realised quickly that while the stock market was a great way to build wealth, there was more to it than just pick and hope.

That’s when I started to look into it further into it and realised that while I was on the right track, I hadn’t yet fully invested enough time to learn why some stocks did well, and others didn’t.

So I came up with a formula for choosing great companies that required certain criteria. It was the start of my growth investing strategy. Most of the criteria I came up with was a hybrid of what I read about Warren Buffett’s strategies and other key investors.

That method, investing for growth, served me well for most of my investing years, until recently as I’ve ‘retired’ early and have switched to an income-producing portfolio.

But while I’m on an income producing journey of investing now, those growth years were what allowed me to get here.

What is Investing for Growth?

A little clarification probably wouldn’t go astray right now. What exactly do I mean by growth investing?

There are only two main ways to invest in the stock market.

I know, you’ll probably go and tell me that there are many more than that, and yes, of course, you can do all sorts of complicated things like short selling, buying options, borrowing for the leverage and so on.

But the average person isn’t going to do that.

They already think that investing in stocks is complicated enough, they aren’t about to go jump into shorting warrants. No. Plus I would argue that all these complicated methods are just fancy ways for quick growth anyway.

Most of us like to stick with the simple uncomplicated process of just buying a company and holding. Long term preferably because who wants to watch the market every day?

So for most people, there are two ways to invest.

Growth and income.

Growth, the way I define it, is buying stocks at one price and waiting until they increase over time, growing your portfolio, and therefore your money.

Income investing, on the other hand, is buying stocks that produce a high dividend income and using that to live off or supplement your current income.

What About Value Investing?

There is also a lot of talk about value investing. Value investing is usually defined as buying a great company at a low price and then profiting when the market ‘corrects’ itself and values it fairly again.

But really, that’s just growth investing. Buying at one price and watching it rise over time is the same as growth. Don’t call it something different.

All investors want value, whether they are investing for growth, income or the best bargain on a new car. It’s a given.

So I don’t view value investing as any different to growth investing.

But Can’t Companies be Both Growth and Income Stocks?

Sure.

And that’s the best thing about investing.

Even if you invest for growth, you’ll still receive dividends on some of your stocks. And if you invest for income, the stock price will usually rise over time too.

The only thing that’s different is what you’re looking for. Dividend yield vs earnings growth.

But You’ve Been Banging on About Dividend Investing Lately, Isn’t That Better Than Growth Investing?

Growth investing is a great way to build your portfolio over the long term and grow your net worth.

Dividend investing is a great way to sit back on your sofa and watch Netflix while the money comes in.

However, with dividend investing, you need a pretty large portfolio to be financially independent and live off the income. Not that it’s everyone’s goal to retire early, some just want to supplement their income with dividends and that’s fine too. But you’re looking to receive an income of around $50,000 a year, you’ll need around a million in the stock market with yields above 5% to put your feet up and relax.

Most people start with just one or two companies and build from there.

I started with just $2,000 around seventeen years ago.

So Growth Investing is Better in the Beginning?

I think growth investing is a good place to start. Not that you can’t start with dividend investing, which is also a good way to build a portfolio over time (especially if you re-invest the dividends).

It really comes down to what you prefer.

Growth investing is best when you are young and have time on your side. It’s a brilliant long term strategy.

So if you’re working, don’t need the supplemental income, and have money to spare to invest with, then growth investing is where you should start.

If you do need extra income or like the idea of building your portfolio passively with DRIPs (Dividend Reinvesting Plans) then invest for income.

Okay, so How Do I Invest for Growth?

There are a few different factors to look for when choosing companies to invest in for growth.

Here’s what you should look for:

- Companies that have five years history (at least) on the Stock Exchange

- The biggest companies by Market Capitalisation

- Debt to Equity Ratio under 80%

- Return on Equity (ROE) over 15%, and

- High Earnings Stability.

Let’s look at each of these in more detail:

Companies that Have High Capitalisation

The easiest place to start when choosing which companies to invest in is those that have the highest market capitalisation in the stock market.

What does this mean? It basically means the biggest companies by size (profits) listed on the stock exchange. Sticking with the bigger companies means that you’re not wasting time on those small companies that have a great chance of failing.

Sure, smaller companies also have a great chance of making you a lot of money in a short space of time, but they also have the greatest risk of going belly-up too. In short, the risk is too high to worry about companies that aren’t established.

The companies with the highest market caps are those that are in the ASX200 in Australia (Top 200 companies by market cap) or S&P500 in the US (Top 500 companies).

You can even narrow it further and just look at the ASX20 and start there. That’s the top 20 companies making your research even easier.

If it’s in the index, you can move on.

Companies That Have Been Listed on the Exchange at Least 5 Years

To establish whether it’s a company worth investing in, the more data you have the better.

I don’t invest in IPOs (Initial Public Offerings) for that very reason, I just don’t have enough information as to whether it’s a good investment or not yet. Some IPO’s do excellent, some don’t.

Once the company has been listed on the stock exchange they are required to report all their earnings and business dealings. That’s real info rather than a prospectus written by the marketing team (which is often all you’ll get when investing in a new company).

I know some people can value a company without this information, but they are smarter than me. I can’t. I need the data.

So I require they have at least five years listed on the stock exchange so I can review their earnings and history.

Return on Equity (ROE)

The Return on Equity (ROE) figure is a determination of how much profit the company makes on behalf of shareholders. Usually, the higher the ROE the better as it indicates how the company is doing financially.

I like companies with ROE’s above 15%. You can go a bit lower if you want, but not too much.

It’s pretty easy to find ROE as it’s a major fundamental for most investors.

Here’s Commonwealth Bank’s ROE:

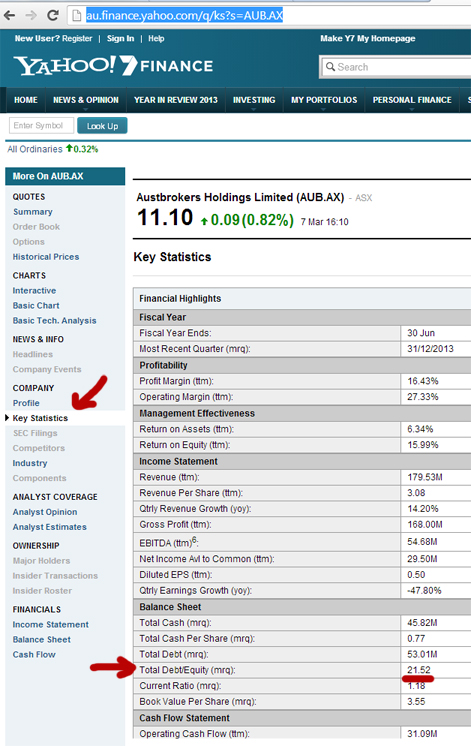

Debt to Equity Ratio less than 80%

Debt to Equity measures how much debt the company carries. If it’s over 100% then the company owes more to the bank that it’s earning. This can be problematic if the company gets into trouble, just like for a regular person up to their eyeballs in debt they can’t afford.

That’s not to say that they will get into problems, just if they do, they won’t have the cash to pay out shareholders and if they go under, so does your money.

So, I like to keep Debt to Equity under 80%. Under 75% is even better.

Now, not all companies will have a debt to equity figure. For example, banks and other financial institutions won’t as they are the ones lending the money rather than borrowing it.

Here’s Austbrokers debt to equity figure:

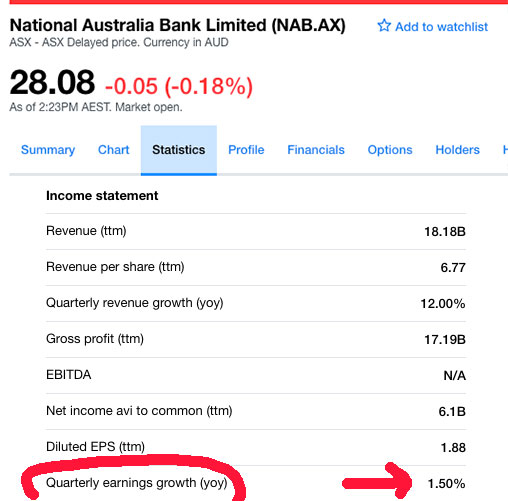

Earnings Stability

I like boring stocks (and I cannot lie).

That means if their earnings are stable without a lot of change each year (with some growth thrown in) it’s a positive sign.

Short term investors don’t rely on this figure because they want the volatility to trade, but long term investors absolutely want to be able to predict what the company is going to do year after year.

Sometimes the statistics page will give you an earnings stability figure, other times it’ll show you earnings growth year on year. If it shows stability, look for a high number (over 80%). If it only shows earnings growth look for something with a swing of between (-5% to 10%). Close to zero means stability of almost 100%.

Growth Investing Sounds Awesome

It can be, in a stable or rising market.

But just be aware that the stock market does cycle and at some stage, those nice stable companies will fall in stock price.

Yikes, right?

Not really. As long as you don’t panic invest you’ll be okay over the long term. I’ve been through two major crashes, one was particularly bad around ten years ago.

But here I am, still investing and stronger than ever.

Will I Lose All My Money?

Hopefully not!

Keep a diversified portfolio of at least five companies, preferably somewhere between ten and twenty.

Or if you don’t want to choose that many yourself, just get an Exchange Traded Fund instead. (You don’t need to worry about these rules if you buy an ETF because the diversification will be enough to cover any market fluctuations).

Remember—the only time you lose money in the stock market in a falling market is when you sell. So don’t. Wait it out. Patience grasshopper.

That’s different to losing money on a company that has failed and become bankrupt. (Did you know that most of the companies where investors lost all their money had very high debt to equity ratios? Worth keeping in mind).

And the only way to protect yourself from that is to invest in a portfolio of companies and stay smart.

Growth Investing Sounds Awful

Nah. Just play the long game, diversify, and keep building up your investments.

Growth investing is a long term strategy which is why you should start the earlier that you can. It’s not a strategy for someone wanting to retire in the next five years.

History tells us that the stock market doubles every seven’ish years.

That means if you continue to invest for seven, fourteen, even twenty one years that you could double, quadruple, even octuple your money. As long as you stay consistent.

When I Get Old I Should Switch To Income Investing?

Ahem, careful of who you call old buddy. 😉

You can switch to (or start) an income strategy anytime you like. It’s a much more hands off method of investing (except when setting up your portfolio in the beginning).

Plus you don’t have to worry about the stock price as much because, who cares, companies still pay dividends no matter what the market is doing.

I’m still young’ish and I personally prefer it now. 🙂

—

Cover Photo by Bruce Mars @ Unsplash